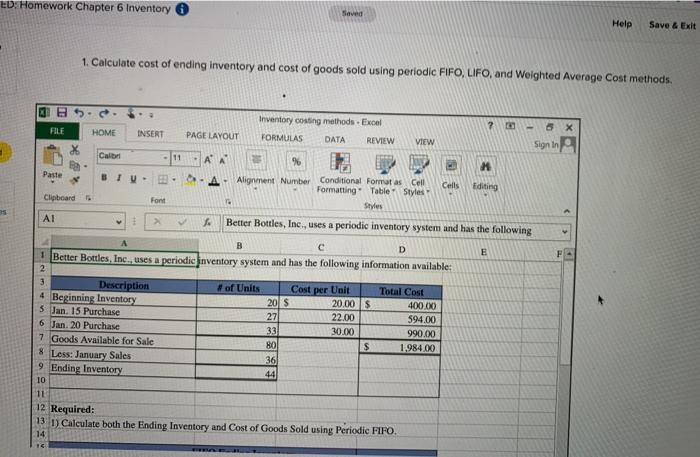

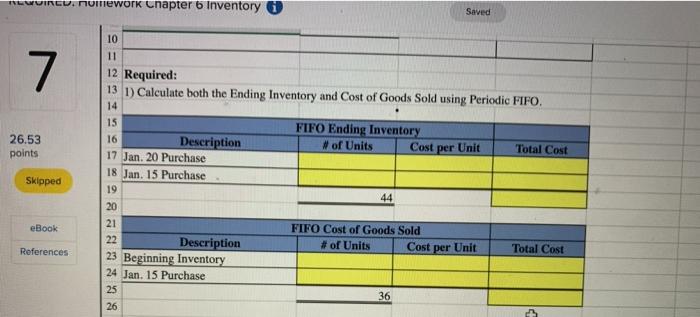

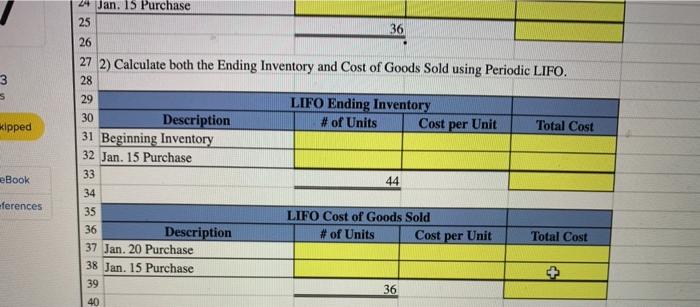

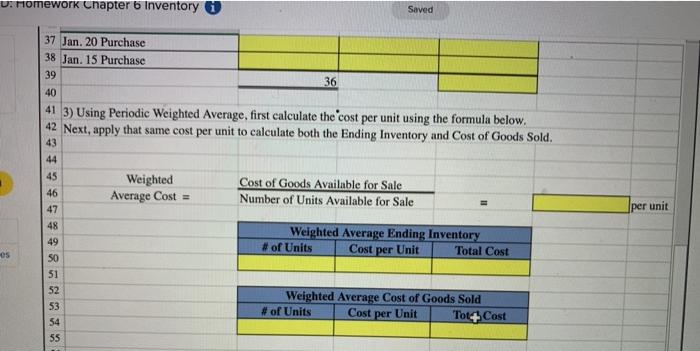

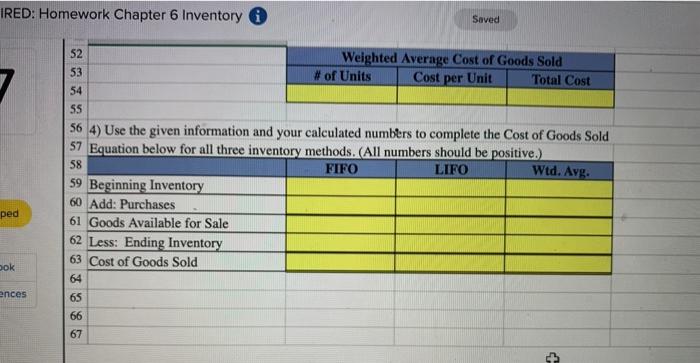

Question: ap/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%- 5 Inventory Saved All answers must be entered as a formula. Click OK to begin. OK EDs Homework Chapter 6 Inventory 6 Seved Help

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock