Question: Choose the correct answer Question 4 (2 points) ) Listen Which of the following is not an inclusion under ITA 12? Reserves from prior years

Choose the correct answer

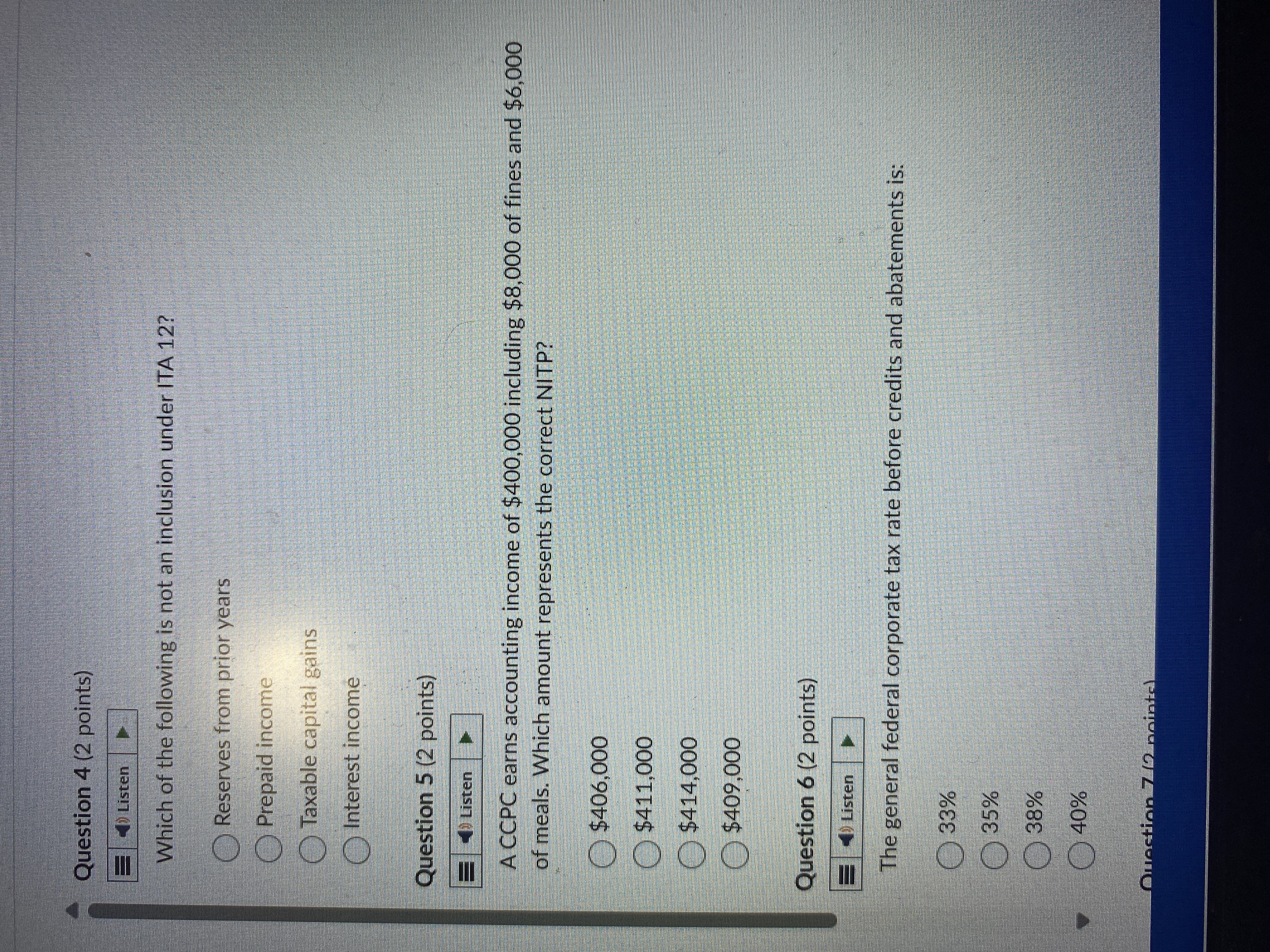

Question 4 (2 points) ) Listen Which of the following is not an inclusion under ITA 12? Reserves from prior years Prepaid income Taxable capital gains Interest income Question 5 (2 points) Listen A CCPC earns accounting income of $400,000 including $8,000 of fines and $6,000 of meals. Which amount represents the correct NITP? $406,000 $411,000 $409,000 Question 6 (2 points) () Listen The general federal corporate tax rate before credits and abatements is: 33% 35% 38% 40% Question 7 02 20

Question 4 (2 points) ) Listen Which of the following is not an inclusion under ITA 12? Reserves from prior years Prepaid income Taxable capital gains Interest income Question 5 (2 points) Listen A CCPC earns accounting income of $400,000 including $8,000 of fines and $6,000 of meals. Which amount represents the correct NITP? $406,000 $411,000 $409,000 Question 6 (2 points) () Listen The general federal corporate tax rate before credits and abatements is: 33% 35% 38% 40% Question 7 02 20

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock