Question: Consider a stock S with initial price S(0) = $90 and with dividend payment of $5 at time t = 1/2. European options on

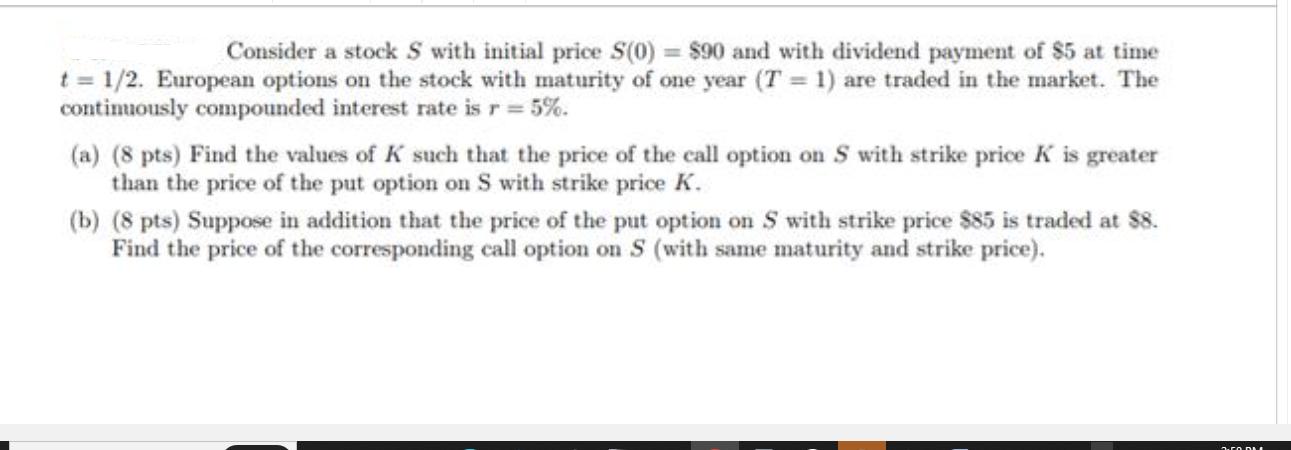

Consider a stock S with initial price S(0) = $90 and with dividend payment of $5 at time t = 1/2. European options on the stock with maturity of one year (T= 1) are traded in the market. The continuously compounded interest rate is r = 5%. (a) (8 pts) Find the values of K such that the price of the call option on S with strike price K is greater than the price of the put option on S with strike price K. (b) (8 pts) Suppose in addition that the price of the put option on S with strike price $85 is traded at 88. Find the price of the corresponding call option on S (with same maturity and strike price).

Step by Step Solution

There are 3 Steps involved in it

The image you provided contains a finance problem related to the pricing of European options on a stock Lets approach the problem step by step The giv... View full answer

Get step-by-step solutions from verified subject matter experts