Question: Elective deferrals including deferrals under a simple retirement account that is part of a section 401(k) arrangement should be reported in Box 12, using

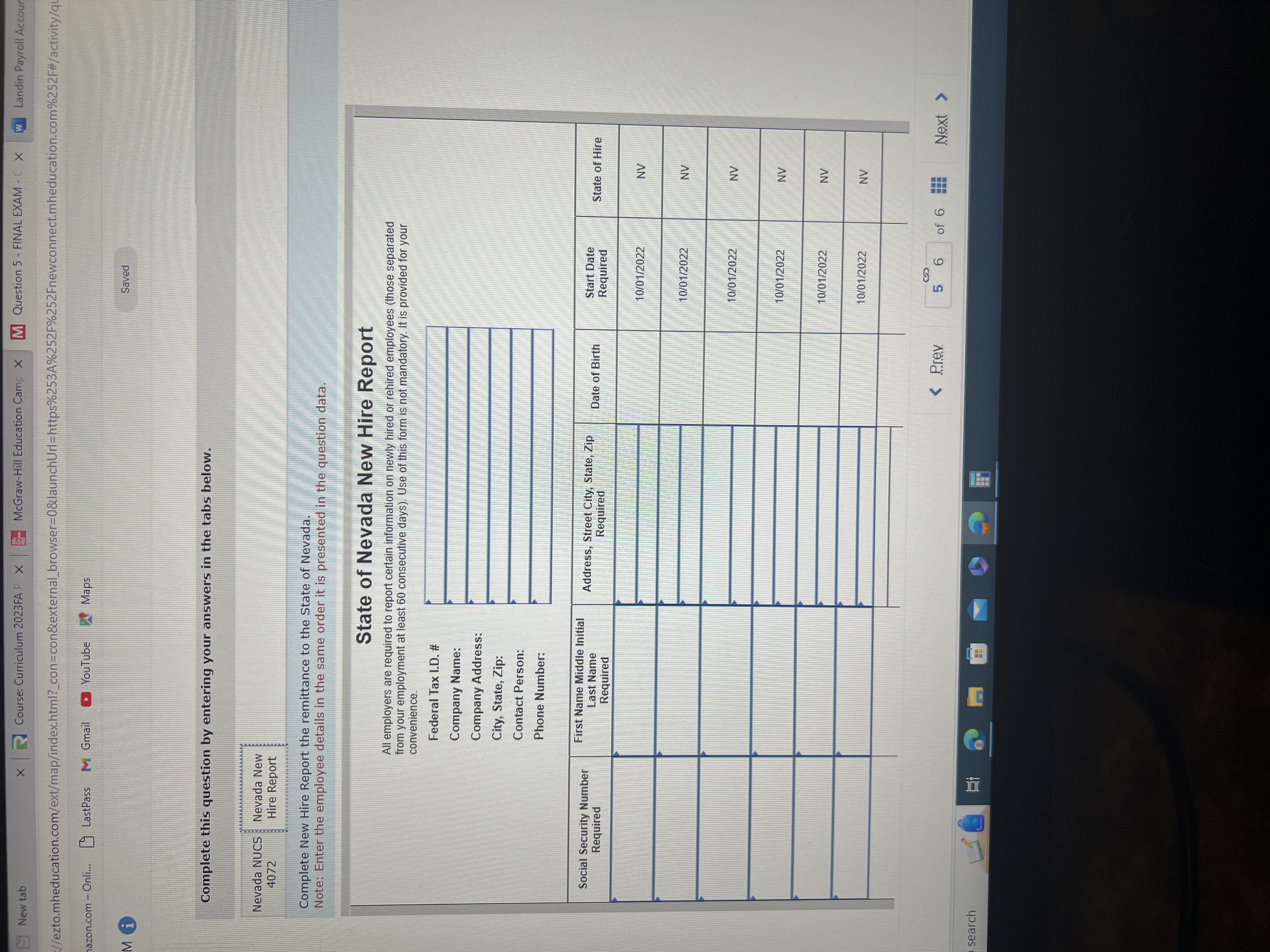

Elective deferrals including deferrals under a simple retirement account that is part of a section 401(k) arrangement should be reported in Box 12, using code D. Employer amounts for health coverage should be reported as 1.5 times the employee's premium in Box 12, using Code DD. Specific instructions on how to complete each form can be found within the individual forms themselves. The employee information for Wayland has been presented again below, for convenience. Employee Number 00-Chins 00-Wayla 01-Peppi 01-Coope 02-Hisso 00-Succe Name and Address Anthony Chinson 530 Chimney Rock Road Stateline, NV 89449 775-555-1212 Job title: Account Executive Mark Wayland 1650 Power House Drive Glenbrook, NV 89413 775-555-1110 Job title: President or Owner Sylvia Peppinico 1575 Flowers Avenue Glenbrook, NV 89413 775-555-2244 Job title: Craftsman Stevon Cooper 2215 Lands End Drive Glenbrook, NV 89413 775-555-9981 Job title: Craftsman Leonard Hissop 333 Engine House Circle Glenbrook, NV 89413 775-555-5858 Job title: Purchasing or Shipping Student Success 16 Kelly Circle number 2 Glenbrook, NV 89413 775-556-1211 Job title: Accounting Clerk Total deposits made for the quarter is $12,617.72 Monthly tax liability: October November $ 6,176.99 6,440.73 Payroll information Married Filing Jointly; 2 < 17 Exempt $48,000 per year commission Start Date: 10/1/2022 SSN: 511-22-3333 Married Filing Jointly; 3 <17, 1 Other Exempt $85,000 per year Start Date: 10/1/2022 SSN: 505-33-1775 Married Filing Jointly; 1 <17, 1 Other Exempt $58,500 per year Start Date: 10/1/2022 SSN: 047-55-9951 Single; None Nonexempt $62,000 per year Start Date: 10/1/2022 SSN: 022-66-1131 Single; 1 Other Nonexempt $51,500 per year Start Date: 10/1/2022 SSN: 311-22-6698 Single: None Nonexempt $42,000 per year Start Date: 10/1/2022 SSN: 555-55-5555 New tab Course: Curriculum 2023FA P. X McGraw-Hill Education Camp X M Question 5 - FINAL EXAM-CX W Landin Pay ps://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/a Amazon.com - Onli... LastPass M Gmail YouTube Maps KAM i Saved Monthly tax liability: October November December $ 6,176.99 6,440.73 3,172.04 FUTA tax deposited for the year, including any overpayment applied from a prior year is $252.00. If you have submitted Part 1 already, it is recommended that you access your submission while attempting Part 2, as you will need the information from Part 1 in order to complete all applicable tax forms. For additional instructions on how to navigate and work through through Part 2 of this project, please download the student project guide here. Required: 3. Complete Nevada NUCS 4072 and New Hire Report for the remittance to the State of Nevada. to search Complete this question by entering your answers in the tabs below. Nevada NUCS 4072 Nevada New Hire Report Complete New Hire Report the remittance to the State of Nevada. Note: Enter the employee details in the same order it is presented in the question data. State of Nevada New Hire Report All employers are required to report certain information on newly hired or rehired employees (those separated from your employment at least 60 consecutive days). Use of this form is not mandatory. It is provided for your convenience. Federal Tax I.D. # Company Name: Company Address: City, State, Zip: Contact Person: Phone Number: First Name Middle Initial S < Prev 5 6 of 6 Next > Question 5 - FINAL EXAM - CX W Landin Payroll Accounting A X landin 3e Video 3 - Carrying X Student Files first video edite > ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/kEZASsBkEPtaQYqNraf7Ugg Ez-4jLDDYpTzt... A Amazon.com - Onli... LastPass M Gmail YouTube Maps AL EXAM i LO Complete this question by entering your answers in the tabs below. Saved 3 of 4 Nevada NUCS 4072 Nevada New Hire Report Complete Nevada NUCS 4072 for the remittance to the State of Nevada. Note: Round your final answers to 2 decimal places. Enter the employee details in the same order it is presented in the question data. EMPLOYER'S QUARTERLY CONTRIBUTION AND WAGE REPORT DO NOT STAPLE THIS FORM State of Nevada Department of Employment, Training & Rehabilitation EMPLOYMENT SECURITY DIVISION 500 E. Third St., Carson City, NV 89713-0030 Telephone (775) 687-4540 PLEASE CORRECT ANY NAME OR ADDRESS INFORMATION BELOW. 1a. EMPLOYER ACCOUNT NUMBER E6462582020-6 e to search 3. TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER (If you paid no wages, write "NONE," sign report and return.) (See Instructions) LESS WAGES IN EXCESS OF 32500 PER INDIVIDUAL 4. (cannot exceed amount in Item 3.) 5. TAXABLE WAGES PAID THIS QUARTER (Item 3 less Item 4.) (See Instructions) 1b. FOR QUARTER ENDING 1e. FEDERAL I.D. Number 1c. DELINQUENT AFTER 1d. YOUR RATES UI CEP IMPORTANT FOR YOUR PROTCTION VERIFY YOUR FEDERAL I.D. NO ABOVE IF IT 18 IN ERROR, PLEASE ENTER THE CORRECT NUMBER HERE A REPORT MUST BE FILED INSTRUCTIONS ENCLOSED 2. REPORT OF CHANGES If any of the following changes have occurred, please check the appropriate box and provide details on page 2. Business Discontinued Ownership Change Entire Business Sold Part of Business Sold 6 UI AMOUNT DUE THIS QUARTER (Item 5 x your UI Rate shown in Item 1d.) 7. CEP AMOUNT DUE THIS QUARTER (Item 5 x the CEP Rate in Item 1d.) (Add) (Do not include the CEP amount on federal unemployment tax return Form 940.) 8 PRIOR CREDIT (Attach "Statement of Employer Account" ) (Subtract) CHARGE FOR LATE FILING OF THIS REPORT 9 (Add) (One or more days late add $5.00 forfeit.) UF ADDITIONAL CHARGE FOR LATE FILING, AFTER 10 DAYS (Add) S < Prev 56 of 6 Next > Local Ownershin Chanae Help Save & Exit Check 52F Partly cloudy New tab x Course: Curriculum 2023FA P. X McGraw-Hill Education Camp X M Question 5 - FINAL EXAM-CX W Landin Payroll Accounting Ap x s://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/kE mazon.com - Onli... LastPass M Gmail YouTube Maps AM i Saved UT CEP 3. TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER (If you paid no wages, write "NONE," sign report and return.) (See Instructions) LESS WAGES IN EXCESS OF 32500 PER INDIVIDUAL (cannot exceed amount in Item 3.) 5. TAXABLE WAGES PAID THIS QUARTER (Item 3 less Item 4.) (See Instructions) 6. UI AMOUNT DUE THIS QUARTER (Item 5 x your UI Rate shown in Item 1d.) 7. CEP AMOUNT DUE THIS QUARTER (Item 5 x the CEP Rate in Item 1d.) (Add) (Do not include the CEP amount on federal unemployment tax return Form 940.) 8. PRIOR CREDIT (Attach "Statement of Employer Account") CHARGE FOR LATE FILING OF THIS REPORT 9. (Subtract) (Add) (One or more days late add $5.00 forfeit.) 10. ADDITIONAL CHARGE FOR LATE FILING, AFTER 10 DAYS (Add) (Item 5 x 1/10% (.001) for each month or part of month delinquent.) INTEREST ON PAST DUE UI CONTRIBUTIONS 11. (Add) (Item 6 x 1% (.01) for each month or part of month delinquent.) (See Instructions) 12. Employer Account Number on check. TOTAL PAYMENT DUE (Total Items 6 through 11.) MAKE PAYABLE TO NEVADA EMPLOYMENT SECURITY DIVISION. Please enter 13. SOCIAL SECURITY NUMBER to search 19. TOTAL PAGES THIS REPORT (1) 14. EMPLOYEE NAME Do not make 15. TOTAL TIPS adjustments to prior quarters. REPORTED Dollars 20 20. TOTAL TIPS AND TOTAL WAGES THIS PAGE 121 I certify that the information contained on this report and the attachments is true and correct GA IL VIVEVI A REPORT MUST BE FILED INSTRUCTIONS ENCLOSED 2. REPORT OF CHANGES If any of the following changes have occurred, please check the appropriate box and provide details on page 2. Business Discontinued Ownership Change Entire Business Sold Part of Business Sold Legal Ownership Change Business Added 0.00 (FOR DIVISION USE ONLY) 16. TOTAL GROSS WAGES INCLUDING TIPS (Dollar and Cents) Cents 17. NUMBER OF WORKERS LISTED ON THIS REPORT 6 18. FOR EACH MONTH, REPORT THE NUMBER OF WORKERS WHO WORKED 0.00 DURING OR RECEIVED PAY FOR THE PAYROLL PERIOD WHICH INCLUDES THE 12TH OF THE MONTH. S 1MO 3MO New tab X Course: Curriculum 2023FA P. X McGraw-Hill Education Camp X M Question 5 - FINAL EXAM-CX WW Landin Payroll Accoun //ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/qu mazon.com - Onli...LastPass M Gmail [] YouTube Mi Maps Complete this question by entering your answers in the tabs below. Saved Nevada NUCS 4072 Nevada New Hire Report Complete New Hire Report the remittance to the State of Nevada. Note: Enter the employee details in the same order it is presented in the question data. State of Nevada New Hire Report All employers are required to report certain information on newly hired or rehired employees (those separated from your employment at least 60 consecutive days). Use of this form is not mandatory. It is provided for your convenience. Federal Tax I.D. # Company Name: Company Address: City, State, Zip: search Contact Person: Phone Number: Social Security Number Required First Name Middle Initial Last Name Required Address, Street City, State, Zip Required Date of Birth Start Date Required State of Hire 10/01/2022 NV 10/01/2022 NV 10/01/2022 NV 10/01/2022 NV 10/01/2022 NV 10/01/2022 NV S < Prev 5 6 of 6 Next >

Step by Step Solution

There are 3 Steps involved in it

To report the elective deferrals including deferrals under a simple retirement account that is part of a section 401k arrangement in Box 12 using code ... View full answer

Get step-by-step solutions from verified subject matter experts