Question: Example 3-1 1. Casey Berra, employed by Gobel Company, earned $460 during the week ended January 25, 20--. Prior to January 25, Berra's cumulative

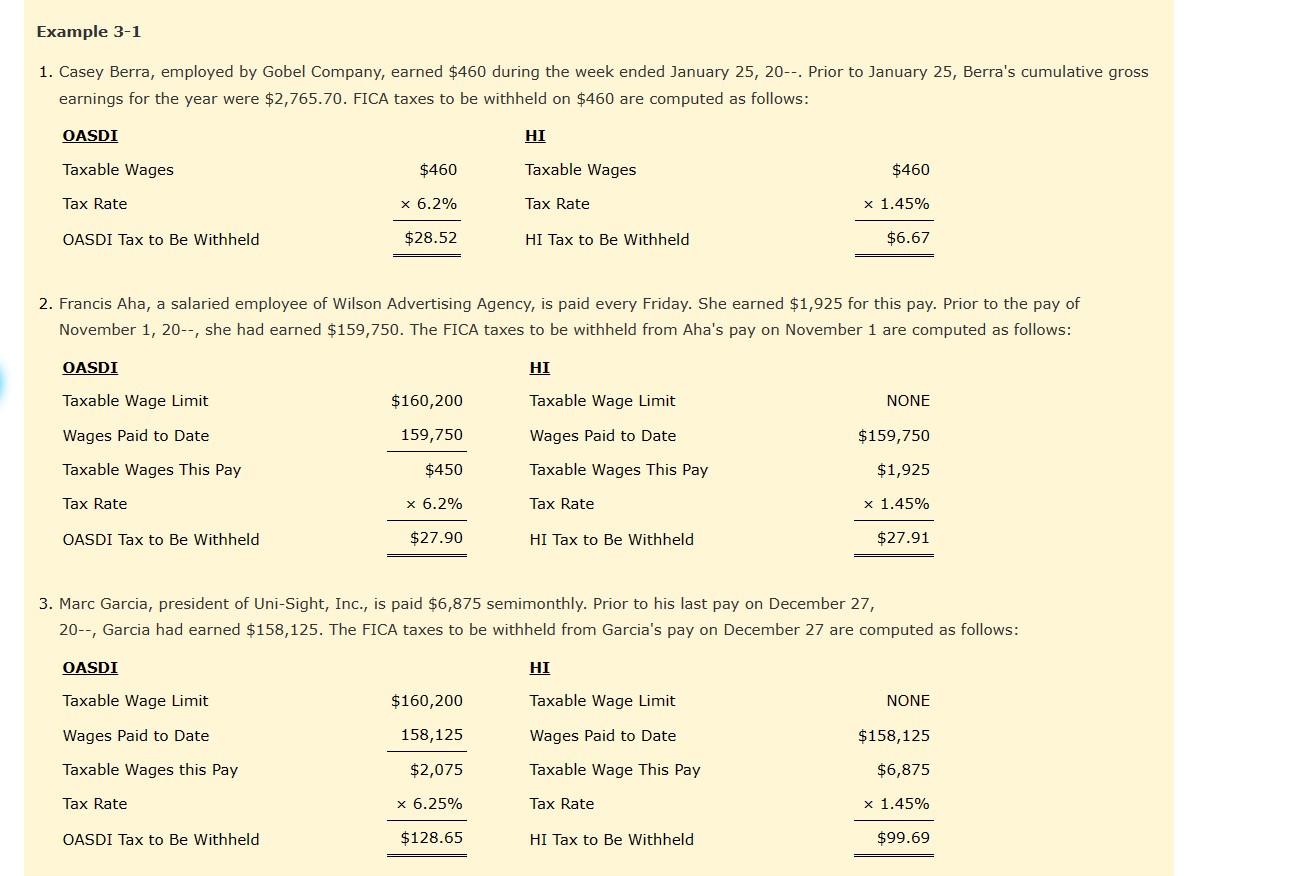

Example 3-1 1. Casey Berra, employed by Gobel Company, earned $460 during the week ended January 25, 20--. Prior to January 25, Berra's cumulative gross earnings for the year were $2,765.70. FICA taxes to be withheld on $460 are computed as follows: OASDI Taxable Wages Tax Rate OASDI Tax to Be Withheld HI $460 Taxable Wages 6.2% Tax Rate $28.52 HI Tax to Be Withheld $460 x 1.45% $6.67 2. Francis Aha, a salaried employee of Wilson Advertising Agency, is paid every Friday. She earned $1,925 for this pay. Prior to the pay of November 1, 20--, she had earned $159,750. The FICA taxes to be withheld from Aha's pay on November 1 are computed as follows: OASDI HI Taxable Wage Limit Wages Paid to Date $160,200 159,750 Taxable Wage Limit NONE Wages Paid to Date $159,750 Taxable Wages This Pay $450 Taxable Wages This Pay $1,925 Tax Rate x 6.2% Tax Rate x 1.45% OASDI Tax to Be Withheld $27.90 HI Tax to Be Withheld $27.91 3. Marc Garcia, president of Uni-Sight, Inc., is paid $6,875 semimonthly. Prior to his last pay on December 27, 20--, Garcia had earned $158,125. The FICA taxes to be withheld from Garcia's pay on December 27 are computed as follows: OASDI HI Taxable Wage Limit $160,200 Taxable Wage Limit NONE Wages Paid to Date 158,125 Wages Paid to Date Taxable Wages this Pay $2,075 Tax Rate x 6.25% Tax Rate OASDI Tax to Be Withheld $128.65 HI Tax to Be Withheld Taxable Wage This Pay $158,125 $6,875 1.45% $99.69

Step by Step Solution

There are 3 Steps involved in it

This example illustrates the calculation of FICA taxes specifically for OASDI OldAge Survivors and D... View full answer

Get step-by-step solutions from verified subject matter experts