Question: From March 9, 2014 until August 15, 2015 Eva is sent to London on a temporary work assignment. Saints's salary during 2014 is $100,

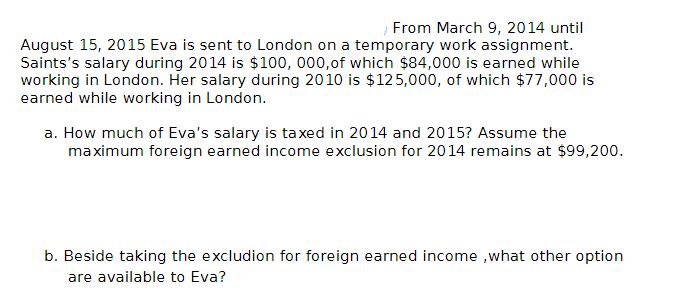

From March 9, 2014 until August 15, 2015 Eva is sent to London on a temporary work assignment. Saints's salary during 2014 is $100, 000, of which $84,000 is earned while working in London. Her salary during 2010 is $125,000, of which $77,000 is earned while working in London. a. How much of Eva's salary is taxed in 2014 and 2015? Assume the maximum foreign earned income exclusion for 2014 remains at $99,200. b. Beside taking the excludion for foreign earned income, what other option are available to Eva?

Step by Step Solution

There are 3 Steps involved in it

The provided image contains a taxrelated question with two parts a and b about Evas salary and the amount subjected to tax for the years 2014 and 2015 ... View full answer

Get step-by-step solutions from verified subject matter experts