Question: Multiple Choice-2 Points Each: 27. Which of the following do not apply to unearned revenues? A. Also called deferred revenues. B. Amounts received in

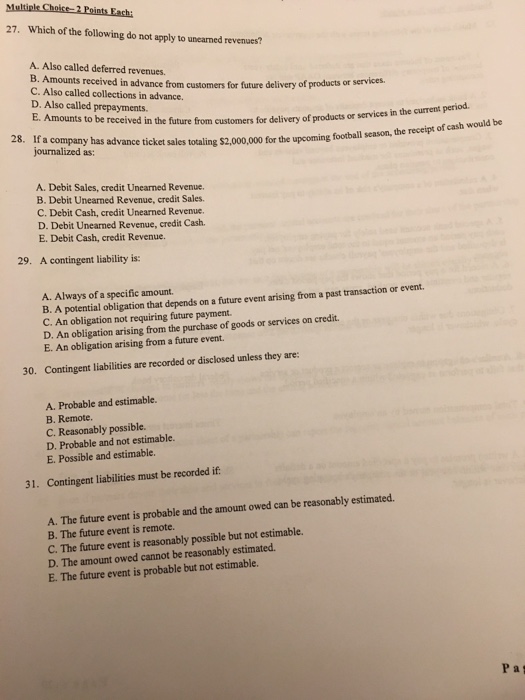

Multiple Choice-2 Points Each: 27. Which of the following do not apply to unearned revenues? A. Also called deferred revenues. B. Amounts received in advance from customers for future delivery of products or services. C. Also called collections in advance. D. Also called prepayments. E. Amounts to be received in the future from customers for delivery of products or services in the current period. 28. If a company has advance ticket sales totaling $2,000,000 for the upcoming football season, the receipt of cash would be journalized as: A. Debit Sales, credit Unearned Revenue. B. Debit Unearned Revenue, credit Sales. C. Debit Cash, credit Unearned Revenue. D. Debit Unearned Revenue, credit Cash. E. Debit Cash, credit Revenue. 29. A contingent liability is: A. Always of a specific amount. B. A potential obligation that depends on a future event arising from a past transaction or event. C. An obligation not requiring future payment. D. An obligation arising from the purchase of goods or services on credit. E. An obligation arising from a future event. 30. Contingent liabilities are recorded or disclosed unless they are: A. Probable and estimable. B. Remote. C. Reasonably possible. D. Probable and not estimable. E. Possible and estimable. 31. Contingent liabilities must be recorded if: A. The future event is probable and the amount owed can be reasonably estimated. B. The future event is remote. C. The future event is reasonably possible but not estimable. D. The amount owed cannot be reasonably estimated. E. The future event is probable but not estimable. Pas

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Answers 27 choice E Amounts that customers will pay in the future for goods or servi... View full answer

Get step-by-step solutions from verified subject matter experts