Question: No steps require JWill Enterprises purchased a depreciable asset for $32,000 on January 1, Year 1. The asset will be depreciated using the straight-line method

No steps require

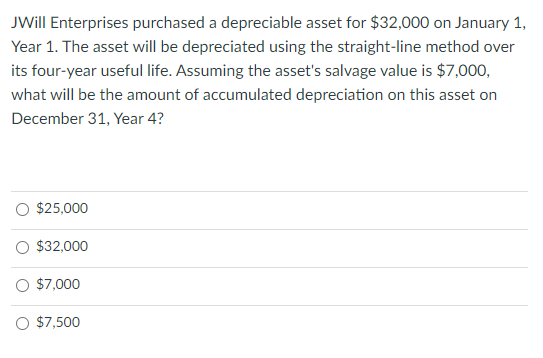

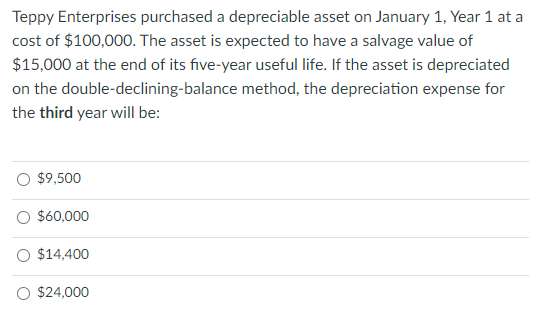

JWill Enterprises purchased a depreciable asset for $32,000 on January 1, Year 1. The asset will be depreciated using the straight-line method over its four-year useful life. Assuming the asset's salvage value is $7,000, what will be the amount of accumulated depreciation on this asset on December 31, Year 4? $25,000 O $32,000 O $7,000 O $7,500 Teppy Enterprises purchased a depreciable asset on January 1, Year 1 at a cost of $100,000. The asset is expected to have a salvage value of $15,000 at the end of its five-year useful life. If the asset is depreciated on the double-declining-balance method, the depreciation expense for the third year will be: O $9,500 O $60,000 $14,400 O $24,000Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock