Question: Rosa Manufacturing presents two direct costs: Direct Material and Direct Labor and a Pool of Indirect Costs. The distribution base of these indirect costs

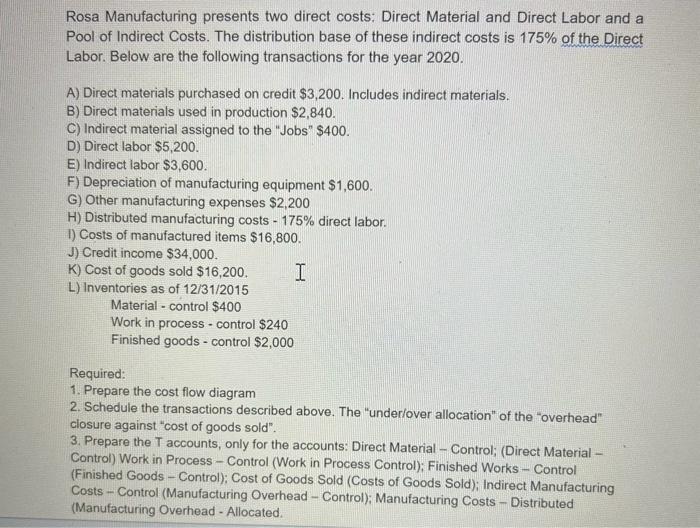

Rosa Manufacturing presents two direct costs: Direct Material and Direct Labor and a Pool of Indirect Costs. The distribution base of these indirect costs is 175% of the Direct Labor. Below are the following transactions for the year 2020. A) Direct materials purchased on credit $3,200. Includes indirect materials. B) Direct materials used in production $2,840. C) Indirect material assigned to the "Jobs" $400. D) Direct labor $5,200. E) Indirect labor $3,600. F) Depreciation of manufacturing equipment $1,600. G) Other manufacturing expenses $2,200 H) Distributed manufacturing costs - 175% direct labor. 1) Costs of manufactured items $16,800. J) Credit income $34,000. I K) Cost of goods sold $16,200. L) Inventories as of 12/31/2015 Material control $400 Work in process - control $240 Finished goods - control $2,000 Required: 1. Prepare the cost flow diagram 2. Schedule the transactions described above. The "under/over allocation" of the "overhead" closure against "cost of goods sold". 3. Prepare the T accounts, only for the accounts: Direct Material - Control; (Direct Material - Control) Work in Process Control (Work in Process Control); Finished Works - Control (Finished Goods - Control); Cost of Goods Sold (Costs of Goods Sold); Indirect Manufacturing Costs - Control (Manufacturing Overhead - Control); Manufacturing Costs - Distributed (Manufacturing Overhead - Allocated.

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

1 Cost Flow Diagram Direct Materials Work in Process Finished Goods Cost of Goods Sold Indirect Manu... View full answer

Get step-by-step solutions from verified subject matter experts