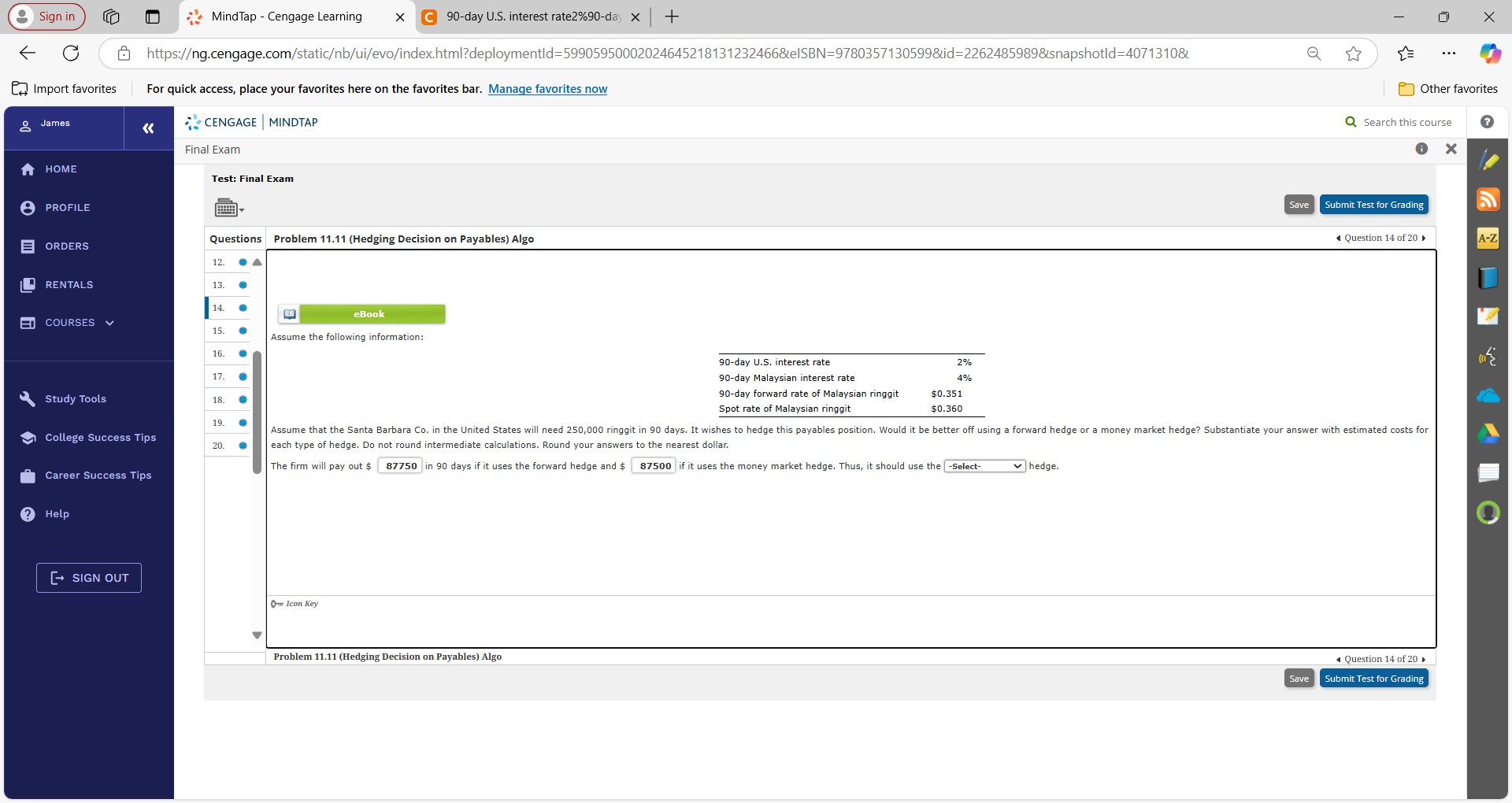

Question: &Sign in MindTap - Cengage Learning X C 90-day U.S. interest rate2%90-day x + X G https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=59905950002024645218131232466&eISBN=9780357130599&id=2262485989&snapshotld=4071310& . . . Pa Import favorites For quick

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts