Question: Signature Why Couldn't This Be Easy, Inc. has two issues of securities outstanding: common stock and $5,400,000 face value, 5-year, 3%, convertible bonds which were

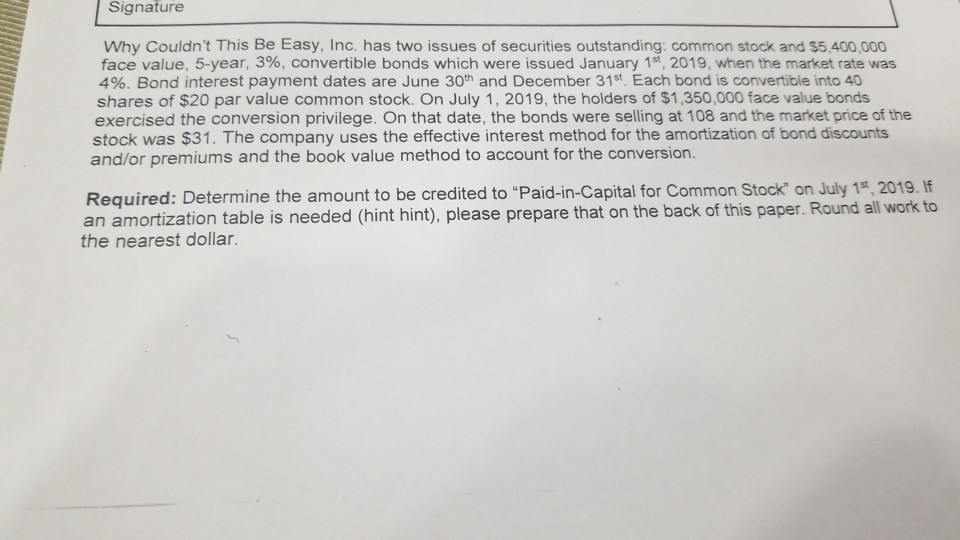

Signature Why Couldn't This Be Easy, Inc. has two issues of securities outstanding: common stock and $5,400,000 face value, 5-year, 3%, convertible bonds which were issued January 1st, 2019, when the market rate was 4%. Bond interest payment dates are June 30th and December 31st. Each bond is convertible into 40 shares of $20 par value common stock. On July 1, 2019, the holders of $1,350,000 face value bonds exercised the conversion privilege. On that date, the bonds were selling at 108 and the market price of the stock was $31. The company uses the effective interest method for the amortization of bond discounts and/or premiums and the book value method to account for the conversion. Required: Determine the amount to be credited to "Paid-in-Capital for Common Stock' on July 1, 2019. If an amortization table is needed (hint hint), please prepare that on the back of this paper. Round all work to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock