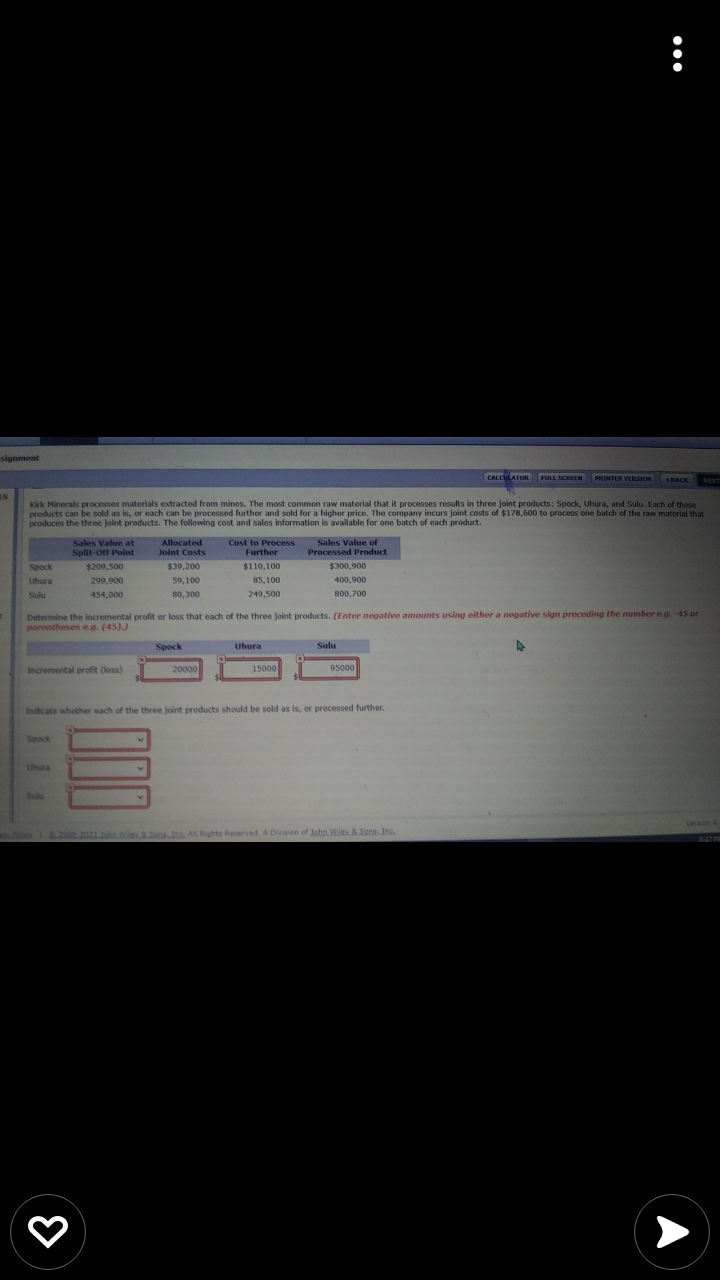

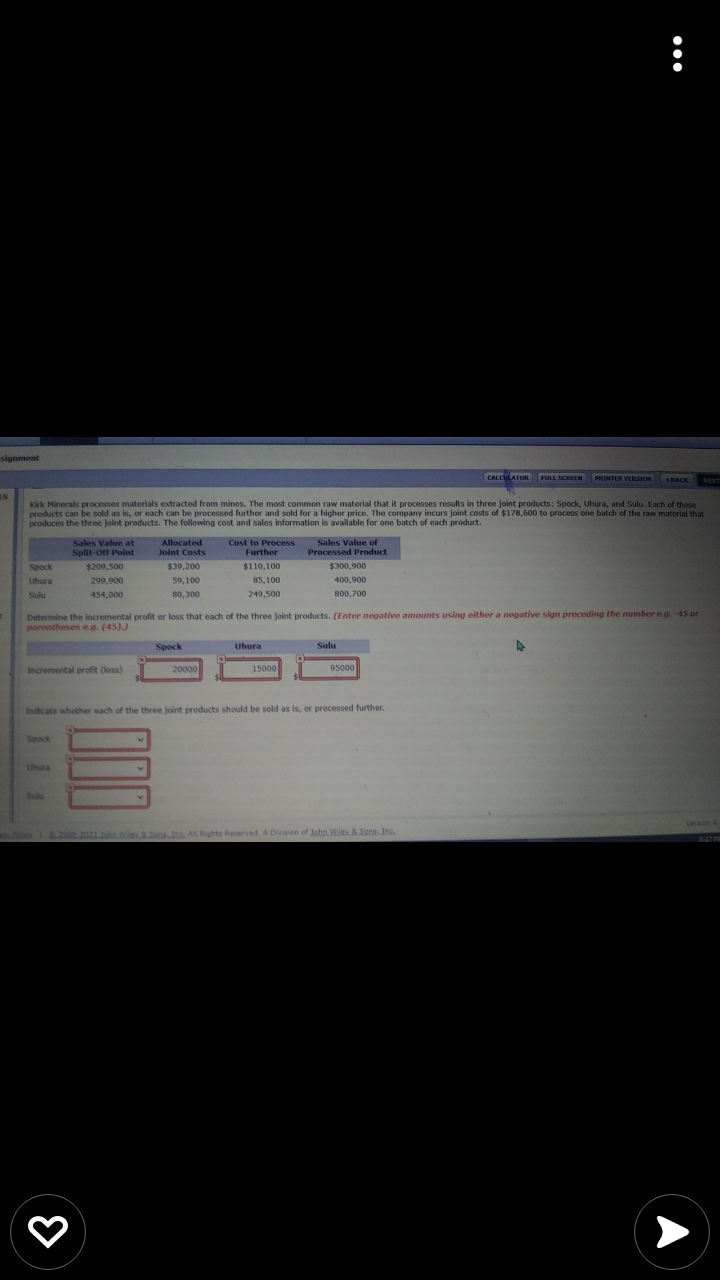

Question: : signment CALCULATOR FULL SCREEN PRINTER VERSION RACK Kliek Minerals processes materials extracted from mines. The most common raw material that it processes results in

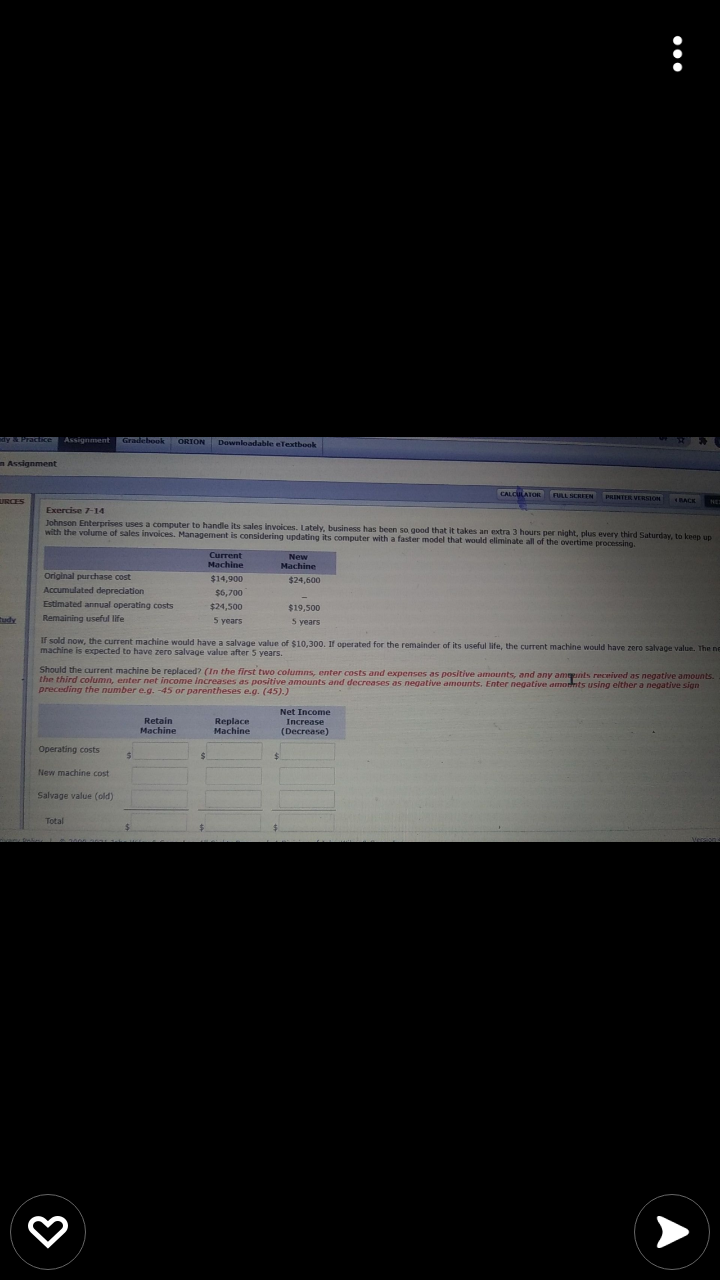

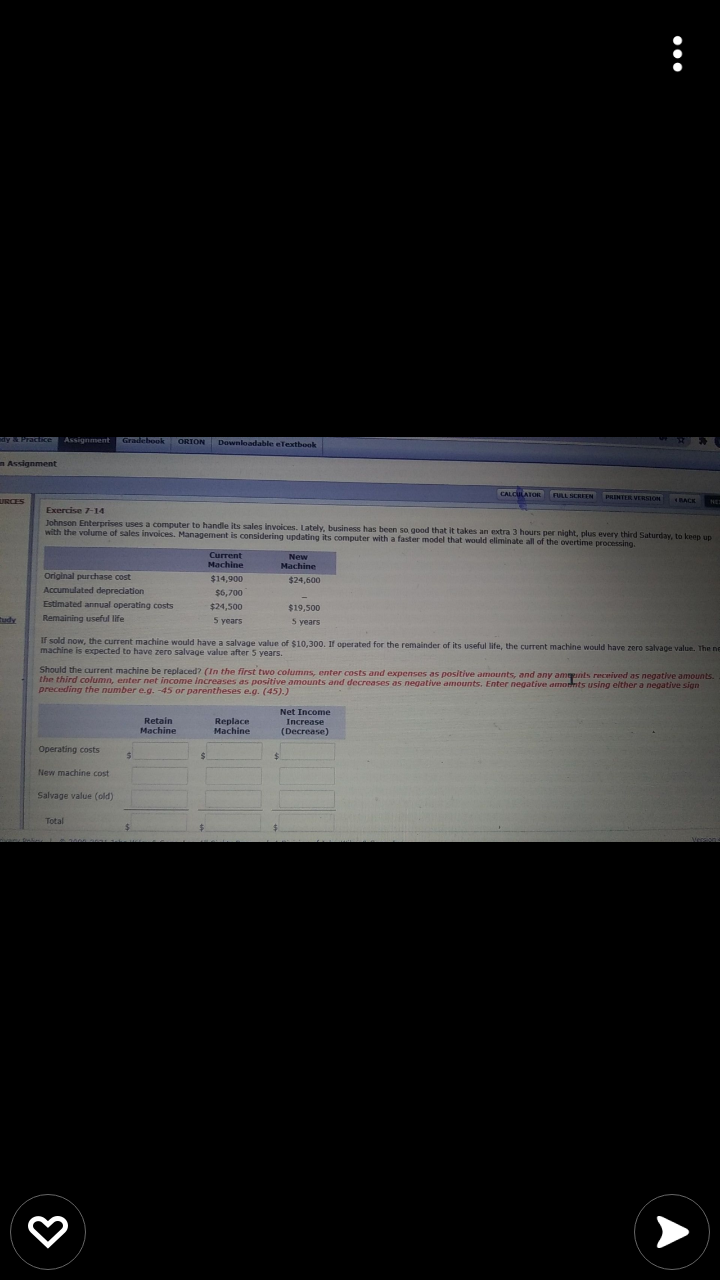

: signment CALCULATOR FULL SCREEN PRINTER VERSION RACK Kliek Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $178,600 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Spock Uhura Sales Value at Split-off Point $209,500 299,900 454,000 Allocated Joint Costs $39,200 59,100 80,300 Cost to Process Further $110,100 85,100 249,500 Sales Value of Processed Product $300,900 400,000 800,700 Sh Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number e... 45 or parenthesese.. (45)) Spock Uhura Suki Incremental profit (loss) 20000 15000 95000 Indicate whether each of the three joint products should be sold as is, or processed further Spock All Rights Reserved. A Division of lowly one : ay Practice Assignment Gradebook ORION Downloadable eTextbook Assignment CALCULATOR FULL SCREEN PRINTER VERSION URCES RACK Exercise 7-14 Johnson Enterprises uses a computer to handle its sales invoices. Lately, business has been so good that it takes an extra 3 hours per night, plus every third Saturday, to keep up with the volume of sales invoices Management is considering updating its computer with a faster model that would eliminate all of the overtime processing. Current New Machine Machine Original purchase cost $14,900 $24,600 Accumulated depreciation $6,700 Estimated annual operating costs $24,500 $19,500 Remaining useful life 5 years 5 years If sold now, the current machine would have a salvage value of $10,300. If operated for the remainder of its useful life, the current machine would have zero salvage value. The ne machine is expected to have zero salvage value after 5 years. Should the current machine be replaced? (In the first two columns, enter costs and expenses as positive amounts, and any agents received as negative amounts. the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sion preceding the number e.g. -45 or parentheses e.g. (45).) Retain Machine Replace Machine Net Income Increase (Decrease) Operating costs $ $ New machine cost Salvage value (old) Total