Question: Solve Exercise 6 (Goodwill Valuation /2 marks) The following information for Al-Riyadh Innovations Company (in #): Normal Rate of Return: Capital Employed: 1 1% 5,000,000

Solve

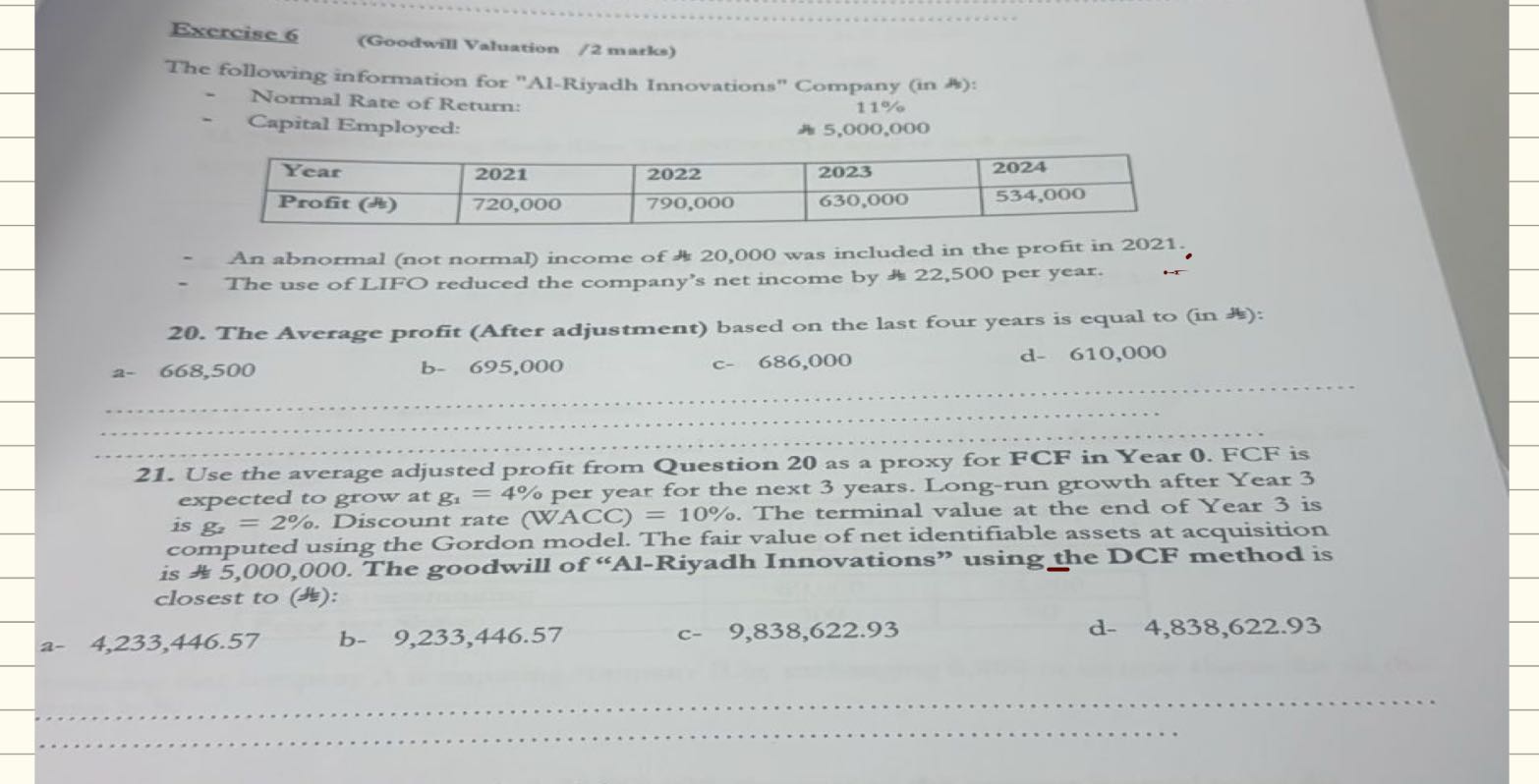

Exercise 6 (Goodwill Valuation /2 marks) The following information for "Al-Riyadh Innovations" Company (in #): Normal Rate of Return: Capital Employed: 1 1% 5,000,000 Year 2021 2022 2023 2024 Profit (3) 720,000 790,000 630,000 534,000 An abnormal (not normal) income of # 20,000 was included in the profit in 2021. - The use of LIFO reduced the company's net income by # 22,500 per year. 20. The Average profit (After adjustment) based on the last four years is equal to (in #4): a- 668,500 b- 695,000 c- 686,000 d- 610,000 21. Use the average adjusted profit from Question 20 as a proxy for FCF in Year 0. FOF is expected to grow at g. = 4% per year for the next 3 years. Long-run growth after Year 3 is g. = 2%. Discount rate (WACC) = 10%. The terminal value at the end of Year 3 is computed using the Gordon model. The fair value of net identifiable assets at acquisition is # 5,000,000. The goodwill of "Al-Riyadh Innovations" using the DCF method is closest to (#): a- 4,233,446.57 b- 9,233,446.57 c- 9,838,622.93 d- 4,838,622.93

Exercise 6 (Goodwill Valuation /2 marks) The following information for "Al-Riyadh Innovations" Company (in #): Normal Rate of Return: Capital Employed: 1 1% 5,000,000 Year 2021 2022 2023 2024 Profit (3) 720,000 790,000 630,000 534,000 An abnormal (not normal) income of # 20,000 was included in the profit in 2021. - The use of LIFO reduced the company's net income by # 22,500 per year. 20. The Average profit (After adjustment) based on the last four years is equal to (in #4): a- 668,500 b- 695,000 c- 686,000 d- 610,000 21. Use the average adjusted profit from Question 20 as a proxy for FCF in Year 0. FOF is expected to grow at g. = 4% per year for the next 3 years. Long-run growth after Year 3 is g. = 2%. Discount rate (WACC) = 10%. The terminal value at the end of Year 3 is computed using the Gordon model. The fair value of net identifiable assets at acquisition is # 5,000,000. The goodwill of "Al-Riyadh Innovations" using the DCF method is closest to (#): a- 4,233,446.57 b- 9,233,446.57 c- 9,838,622.93 d- 4,838,622.93

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock