Question: Star Construction Corp. has a contract to construct a building for $10,876,000. The building is controlled by the customer throughout the term of the

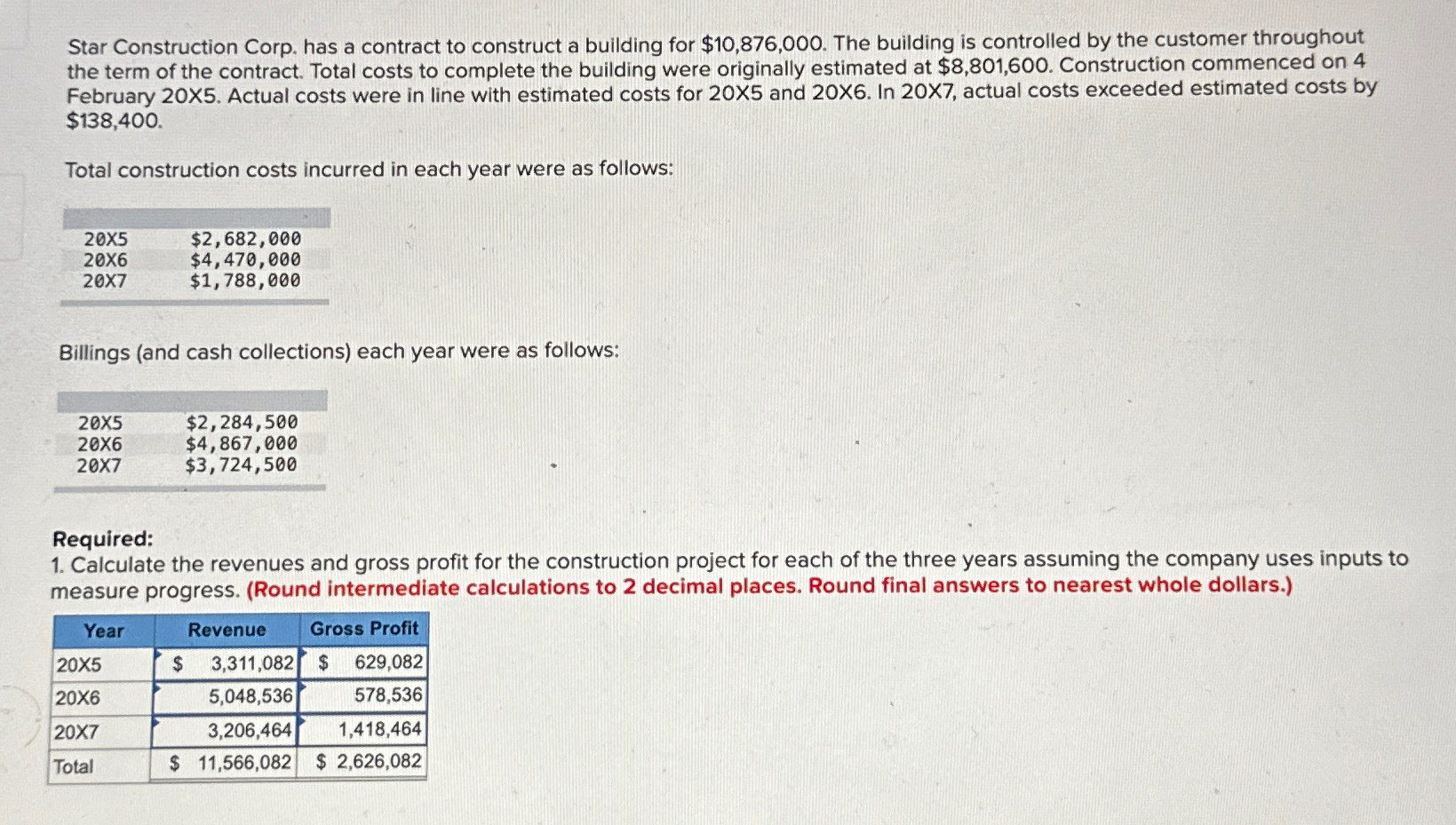

Star Construction Corp. has a contract to construct a building for $10,876,000. The building is controlled by the customer throughout the term of the contract. Total costs to complete the building were originally estimated at $8,801,600. Construction commenced on 4 February 20X5. Actual costs were in line with estimated costs for 20X5 and 20X6. In 20X7, actual costs exceeded estimated costs by $138,400. Total construction costs incurred in each year were as follows: 20X5 20X6 20X7 $2,682,000 $4,470,000 $1,788,000 Billings (and cash collections) each year were as follows: 20X5 $2,284,500 20X6 20X7 $4,867,000 $3,724,500 Required: 1. Calculate the revenues and gross profit for the construction project for each of the three years assuming the company uses inputs to measure progress. (Round intermediate calculations to 2 decimal places. Round final answers to nearest whole dollars.) Revenue Gross Profit $ 3,311,082 $ 629,082 Year 20X5 20X6 20X7 5,048,536 3,206,464 578,536 1,418,464 Total $ 11,566,082 $ 2,626,082

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts