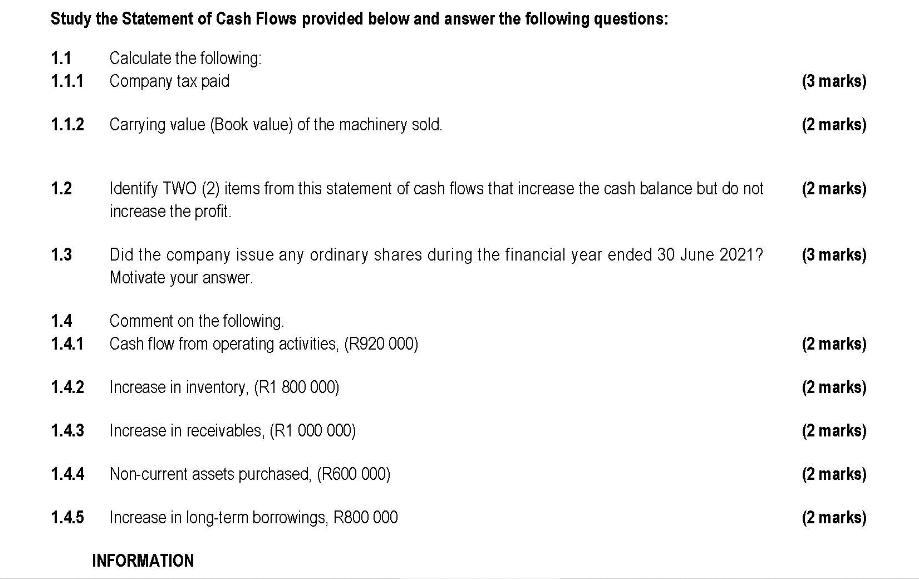

Question: Study the Statement of Cash Flows provided below and answer the following questions: 1.1 Calculate the following: Company tax paid 1.1.1 1.1.2 1.2 1.3

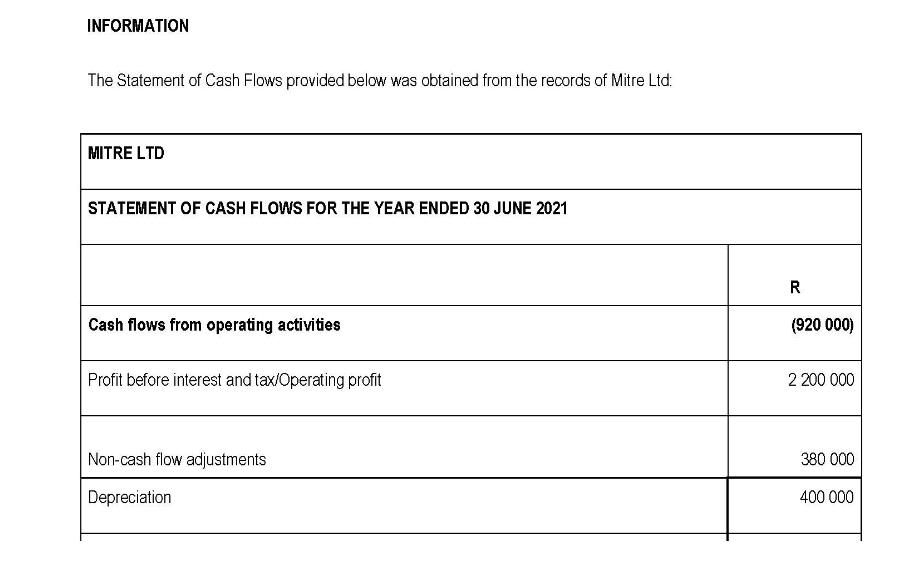

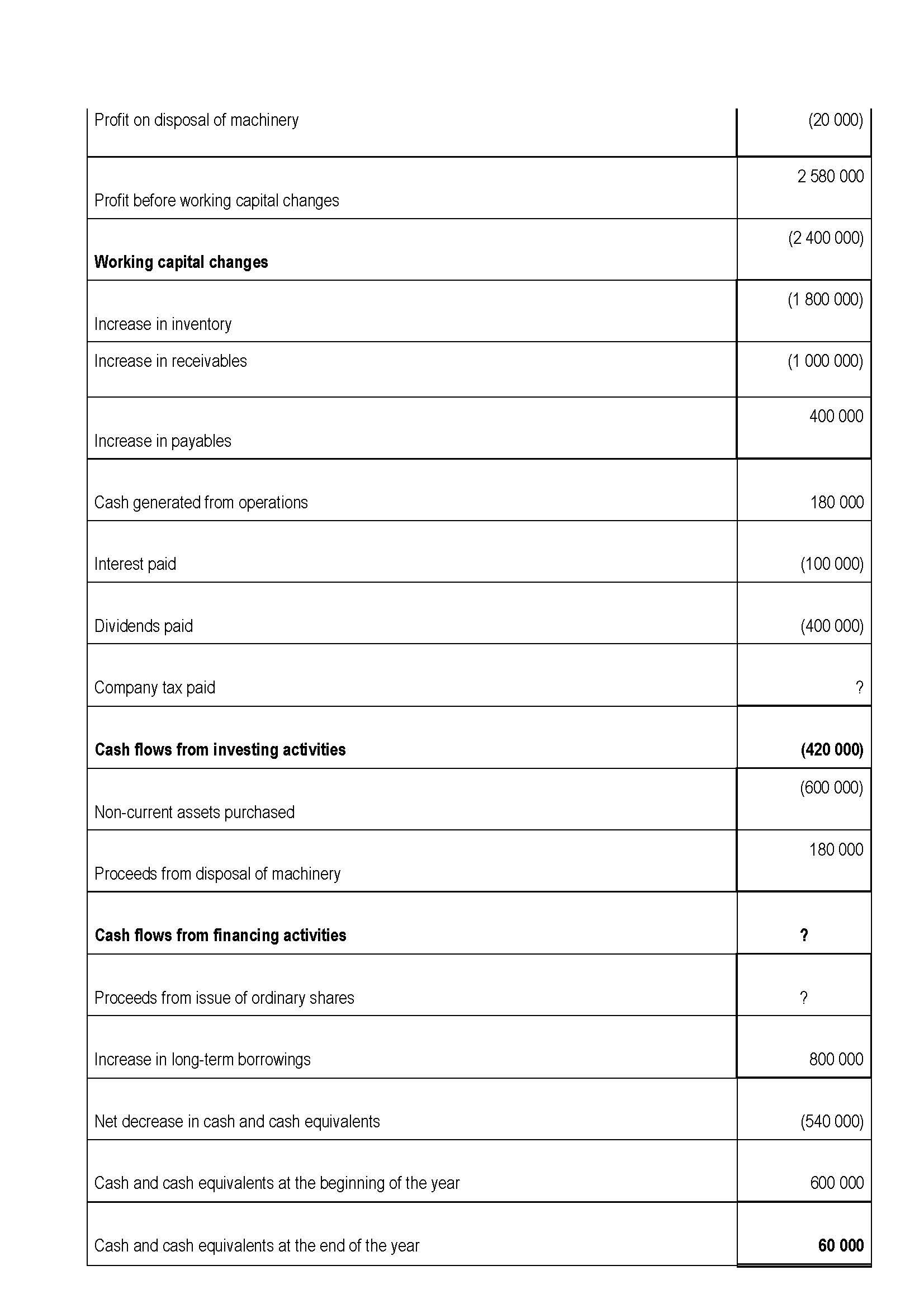

Study the Statement of Cash Flows provided below and answer the following questions: 1.1 Calculate the following: Company tax paid 1.1.1 1.1.2 1.2 1.3 1.4 1.4.1 1.4.2 1.4.3 1.4.4 1.4.5 Carrying value (Book value) of the machinery sold. Identify TWO (2) items from this statement of cash flows that increase the cash balance but do not increase the profit. Did the company issue any ordinary shares during the financial year ended 30 June 2021? Motivate your answer. Comment on the following. Cash flow from operating activities, (R920 000) Increase in inventory, (R1 800 000) Increase in receivables, (R1 000 000) Non-current assets purchased, (R600 000) Increase in long-term borrowings, R800 000 INFORMATION (3 marks) (2 marks) (2 marks) (3 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) INFORMATION The Statement of Cash Flows provided below was obtained from the records of Mitre Ltd: MITRE LTD STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 30 JUNE 2021 Cash flows from operating activities Profit before interest and tax/Operating profit Non-cash flow adjustments Depreciation R (920 000) 2 200 000 380 000 400 000 Profit on disposal of machinery Profit before working capital changes Working capital changes Increase in inventory Increase in receivables Increase in payables Cash generated from operations Interest paid Dividends paid Company tax paid Cash flows from investing activities Non-current assets purchased Proceeds from disposal of machinery Cash flows from financing activities Proceeds from issue of ordinary shares Increase in long-term borrowings Net decrease in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year (20 000) 2 580 000 (2 400 000) (1 800 000) (1 000 000) 400 000 (100 000) 180 000 (400 000) ? (420 000) (600 000) ? ? 180 000 800 000 (540 000) 600 000 60 000

Step by Step Solution

There are 3 Steps involved in it

Lets go through the questions one by one 11 Calculate the following 111 Company tax paid Company tax paid can be calculated by rearranging the cash flows from operating activities equation Cash flows ... View full answer

Get step-by-step solutions from verified subject matter experts