Question: 1. Calculate and record depreciation for the year just ended April 30, 2015, for both the building and equipment. 2. Prepare the property, plant and

1. Calculate and record depreciation for the year just ended April 30, 2015, for both the building and equipment.

2. Prepare the property, plant and equipment section of the balance sheet at April 30,2015.

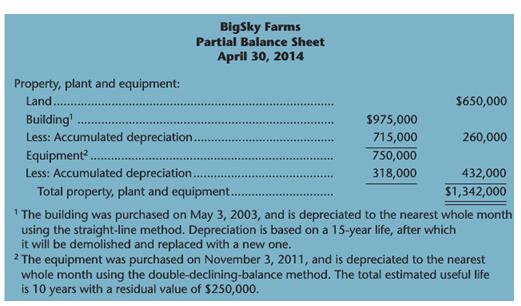

BigSky Farms Partial Balance Sheet April 30, 2014 Property, plant and equipment: Land. $975,000 715,000 750,000 318,000 $650,000 260,000 432,000 Equipment Less: Accumulated depreciation... Total property, plant and equipment... $1,342,000 1 The building was purchased on May 3, 2003, and is depreciated to the nearest whole month using the straight-line method. Depreciation is based on a 15-year life, after which it will be demolished and replaced with a new one. 2 The equipment was purchased on November 3, 2011, and is depreciated to the nearest whole month using the double-declining-balance method. The total estimated useful life is 10 years with a residual value of $250,000

Step by Step Solution

3.24 Rating (179 Votes )

There are 3 Steps involved in it

1 2015 Apr 30 Depreciation Expense Building 65000 Accumulate... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

384-B-A-I-A (4619).docx

120 KBs Word File