Question: A 3:1 reverse hedge (buy three May 30 calls and short the stock). Corporations (fictitious name), where the options expire on the same date in

A 3:1 reverse hedge (buy three May 30 calls and short the stock).

Corporations (fictitious name), where the options expire on the same date in May. Draw profit diagrams in each case, clearly showing the stock price corresponding to zero profit, the maximum profit and loss, and so on.

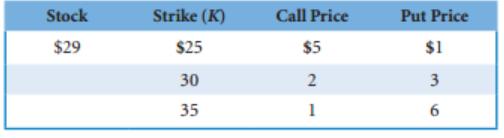

Stock Strike (K) Call Price Put Price $29 $25 $5 $1 30 35 1

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

31 Reverse Hedge Maximum profit is infinite which happen... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

646-B-B-F-M (2835).docx

120 KBs Word File