Question: A balance sheet at December 31, 2011, for the Beck, Dee, and Lynn partnership is summarized as follows: Dee is retiring from the partnership. The

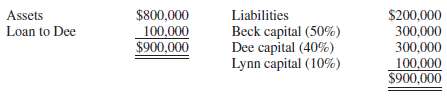

A balance sheet at December 31, 2011, for the Beck, Dee, and Lynn partnership is summarized as follows:

Dee is retiring from the partnership. The partners agree that partnership assets, excluding Dee's loan, should be adjusted to their fair value of $1,000,000 and that Dee should receive $310,000 for her capital balance net of the $100,000 loan. The bonus approach is used; therefore, no goodwill is recorded.REQUIRED: Determine the capital balances of Beck and Lynn immediately after Dee'sretirement.

Liabilities Beck capital (50%) Dee capital (40%) Lynn capital (10%) $200,000 Assets $800,000 100,000 Loan to Dee 300,000 $900,000 100,000 $900,000

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Entry to writeup assets to fair value Assets 200000 Beck capital 100000 Dee ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-P (161).docx

120 KBs Word File