Question: A financial regression analysis was carried out to estimate the linear relationship between long-term bond yields and the yield spread, a problem of significance in

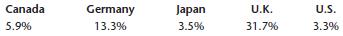

A financial regression analysis was carried out to estimate the linear relationship between long-term bond yields and the yield spread, a problem of significance in finance. The sample sizes were 242 monthly observations in each of five countries, and the results were the obtained regression r2 values for these countries. The results were as follows.

Assuming that all five linear regressions were statistically significant, comment on and interpret the reported r2 values.

Canada 5.9% GermanylapanU.K U.S 3.3% 13.3% 3.596 31.7%

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Based on the coefficient of determination values for the five countries the ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

463-M-S-L-R (2150).docx

120 KBs Word File