Question: A firm wishing to evaluate interest rate behavior has gathered data on the nominal rate of interest and on inflationary expectations for five U.S. Treasury

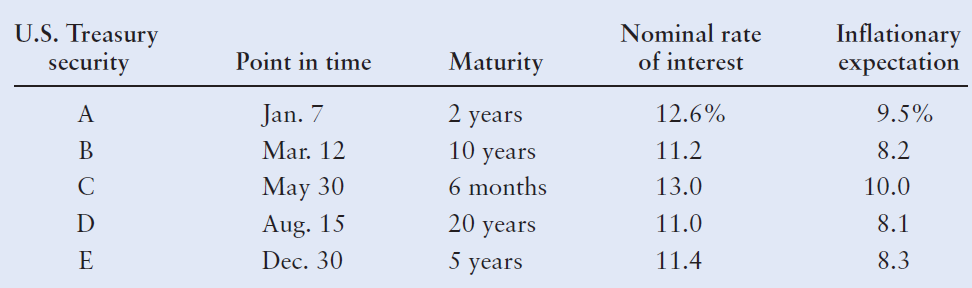

A firm wishing to evaluate interest rate behavior has gathered data on the nominal rate of interest and on inflationary expectations for five U.S. Treasury securities, each having a different maturity and each measured at a different point in time during the year just ended. (Note: Assume that the risk that future interest rate movements will affect longer maturities more than shorter maturities is zero; that is, there is no maturity risk.) These data are summarized in the following table.

a. Using the preceding data, find the real rate of interest at each point in time.

b. Describe the behavior of the real rate of interest over the year. What forces might be responsible for such behavior?

c. Draw the yield curve associated with these data, assuming that the nominal rates were measured at the same point in time.

d. Describe the resulting yield curve in part c, and explain the general expectations embodied init.

U.S. Treasury Nominal rate of interest Inflationary expectation Point in time Maturity Jan. 7 Mar. 12 May 30 Aug. 15 Dec. 30 2 years 10 years 6 months 20 years 5 years 12.6% 11.2 13.0 11.0 11.4 10.0 8.3

Step by Step Solution

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Real rate of interest r r i r IP RP RP 0 for Treasury issues r r i IP a Security Nominal Rate r j ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

96-B-F-M-F (271).docx

120 KBs Word File