Question: a. For the defined benefit, noncontributory retirement plans, compare pension expense (cost) with operating revenue for 2008, 2007, and 2006. Comment. b. For the defined

a. For the defined benefit, noncontributory retirement plans, compare pension expense (cost) with operating revenue for 2008, 2007, and 2006. Comment.

b. For the defined benefit, noncontributory retirement plans, compare pension expense (cost) with income before income taxes for 2008, 2007, and 2006.

c. For the defined benefit, noncontributory retirement plans, compare the benefit obligations with the value of plan assets at the end of 2008 and 2007. Comment.

d. Are all of Safeway's defined benefit noncontributory retirement plans overfunded or underfunded?Comment.

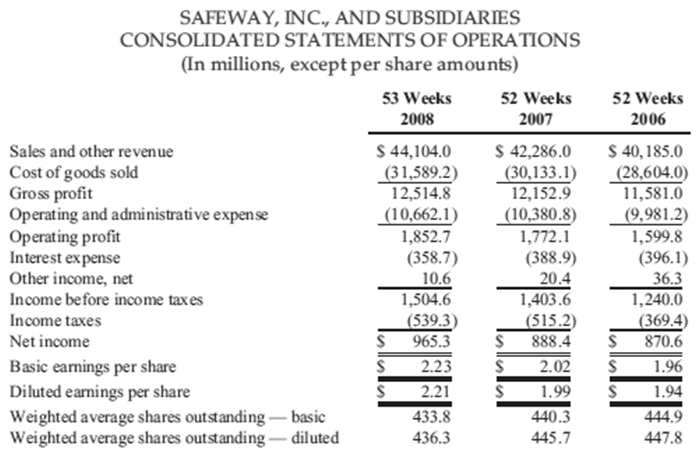

SAFEWAY, INC, AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, exceptper share amounts) 53 Weeks 2008 52 Weeks 52 Weeks 2006 2007 Sales and other revenue Cost of goods sold Gross profit Operating and administrative expen se Operating profit Interest expense Other income, net Income before income taxes Income taxes Net income 44,104.0 42,286.0 40,185.0 1,589.2 30,133.1) 28,604.0 11,581.0 10.662.110.380.8) 9.981.2) 1,599.8 12,514.8 12,152.9 1,852.7 1,772.1 (388.9) 20.4 1,403.6 (358.7) (396.1) 10.6 I,504.6 539.3 965.3 S2.23 36.3 1,240.0 515.2) 3694 515.2(3694) S 888.4 870.6 1.96 1.94 Basic earnings per share Diluted earnings per share Weighted average shares outstanding basic Weighted average shares outstanding -diluted S 2.02 S 433.8 436.3 1.99 440.3 445.7 444.9 447.8

Step by Step Solution

3.61 Rating (165 Votes )

There are 3 Steps involved in it

a Defined benefit noncontributory retirement plans In millions 2008 2007 2006 Pension expense a ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

139-B-A-L (1987).docx

120 KBs Word File