Question: A large corporation recently reported the following amounts on its year-end statements of financial position: A footnote to these statements indicated that the company uses

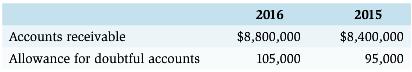

A large corporation recently reported the following amounts on its year-end statements of financial position:

A footnote to these statements indicated that the company uses a percentage of its credit sales to determine its bad debts expense, that $60,000 of uncollectible accounts were written off during 2015 and $80,000 of uncollectible accounts were written off in 2016, and that there were no recoveries of accounts written off.

Required:

a. Determine the amount of bad debts expense that must have been recorded by the company for 2016.

b. How were the company€™s net receivables affected by the write-off of the $80,000 of accounts in 2016?

c. How was the company€™s net earnings affected by the $80,000 write-off of accounts in 2016?

2016 2015 Accounts receivable Allowance for doubtful accounts $8,800,000 8,400,000 95,000 105,000

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

a Ending balance 105000 Plus writeoffs 80000 Less beginning balance 950... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

468-B-A-I (6253).docx

120 KBs Word File