Question: A new $300,000 machine is expected to have a 5-year life and a terminal value of zero. It can produce 40,000 units a year at

A new $300,000 machine is expected to have a 5-year life and a terminal value of zero. It can produce 40,000 units a year at a variable cost of $4 per unit. The variable cost is $6.50 per unit with an old machine, which has a book value of $100,000. It is being depreciated on a straight-line basis at $20,000 per year. It too is expected to have a terminal value of zero. Its current disposal value is also zero because it is highly specialized equipment.

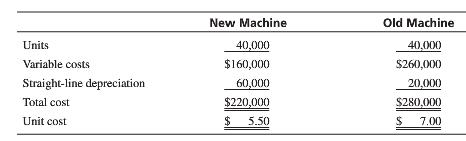

The salesperson of the new machine prepared the following comparison:

He said, “The new machine is obviously a worthwhile acquisition. You will save $1.50 for every unit you produce.”

1. Do you agree with the salesperson’s analysis? If not, how would you change it? Be specific.

Ignore taxes.

2. Prepare an analysis of total and unit differential costs if the annual volume is 20,000 units.

3. At what annual volume would both the old and new machines have the same total relevant costs?

New Machine 40,000 $160,000 60,000 $220,000 $5.50 Old Machine Units Variable costs Straightline depreciation Total cost Unit cost 40,000 $260,000 20,000 $280,000 5 7.00

Step by Step Solution

3.45 Rating (177 Votes )

There are 3 Steps involved in it

1 The salesmans analysis is faulty because it includes depre... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

345-B-M-A-D-M (1692).docx

120 KBs Word File