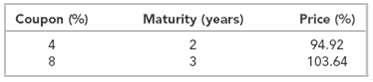

Question: (a) What spot and forward rates are embedded in the following Treasury bonds? The price of one-year (zero-coupon) Treasury bills is 93.46 percent. Assume for

(a) What spot and forward rates are embedded in the following Treasury bonds? The price of one-year (zero-coupon) Treasury bills is 93.46 percent. Assume for simplicity that bonds make only annual payments. Can you devise a mixture of long and short positions in these bonds that gives a cash payoff only in year 2? In year 3?

(b) A three-year bond with a 4 percent coupon is selling at 95.00 percent. Is there a profit opportunity here? If so, how would you take advantage of it?

Coupon (%) Maturity (years) Price (%) 4 94.92 103.64 2 3

Step by Step Solution

3.28 Rating (160 Votes )

There are 3 Steps involved in it

a We make use of the oneyear Treasury bill information in order to determine the oneyear spot rate a... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-D-F (25).docx

120 KBs Word File