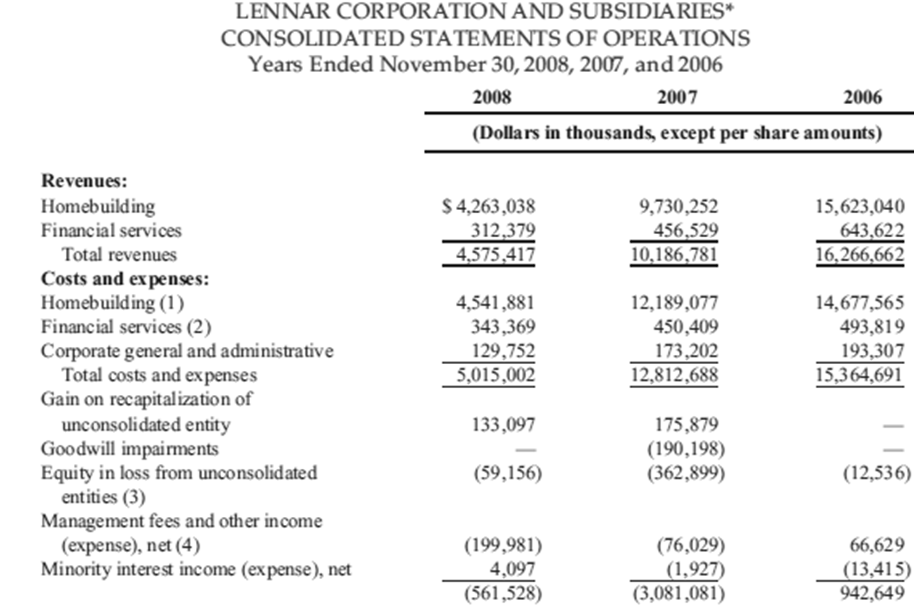

Question: a. Would you consider the presentation to be a multiple-step income statement or a single-step income statement? Comment. b. Does it appear that there is

a. Would you consider the presentation to be a multiple-step income statement or a single-step income statement? Comment.

b. Does it appear that there is a 100% ownership in all consolidated subsidiaries?

c. If a subsidiary were not consolidated but rather accounted for using the equity method, would this change net earnings (loss)? Explain.

d. Describe equity in loss from unconsolidated entities (see Note 3).

e. Comment on Note 1. Does this note project favorably on the future of Lennar Corporation? Explain.

f. Comment on Note 2. Why take an impairment for goodwill under financial services? Why is this goodwill impairment disclosed separately from the line item goodwill impairments for 2007($190,198,000)?

LENNAR CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended November 30, 2008, 2007, and 2006 2007 2006 (Dollars in thousands, except per share am ounts) Homebuilding Financial services $ 4,263,038 312,379 4,575,417 15,623,040 643.622 16,266.662 9,730,252 Total revenues Costs and expenses 0,186,781 4,541,881 343,369 129,752 5,015,002 12,189,077 450.409 Financial services (2) Corporate general and administrative 14,677,565 493,819 193,307 15,364,691 Total costs and expenses Gain on recapitalization of 12,812,688 unconsolidated entity Goodwill impairments Equity in loss from unconsolidated 133,097 175,879 (190,198) (362,899) (59,156 (12,536) entities (3) Management fees and other income (199,981) 4,097 (561,528) 66,629 (13,415) 942,649 (expense), net (4) 76,029) 1,927) (3,081,081) Minority interest income (expense), net

Step by Step Solution

3.49 Rating (176 Votes )

There are 3 Steps involved in it

a Appears to be a modified singlestep income statement b No Minori... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

139-B-A-I-S (708).docx

120 KBs Word File