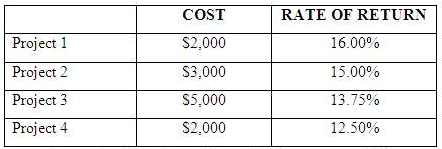

Adams Corporation has four investment opportunities with the following costs and rates of return: The company estimates

Question:

Adams Corporation has four investment opportunities with the following costs and rates of return:

The company estimates that it can issue debt at a before-tax cost of 10 percent, and its tax rate is 30 percent. The company can also issue preferred stock at $49 per share, which pays a constant dividend of $5 per year. The company's stock currently sells at $36 per share. The year-end dividend, D1, is expected to be $3.50, and the dividend is expected to grow at a constant rate of 6 percent per year.

The company's capital structure consists of 75 percent common stock, 15 percent debt, and 10 percent preferred stock.

What is the cost of each of the capital components (debt, preferred equity, and common equity)?

What is the WACC?

Which investments should the firm select if the projects are all of average risk?

What is the cost of each of the capital components (debt, preferred equity, and commonequity)?

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston