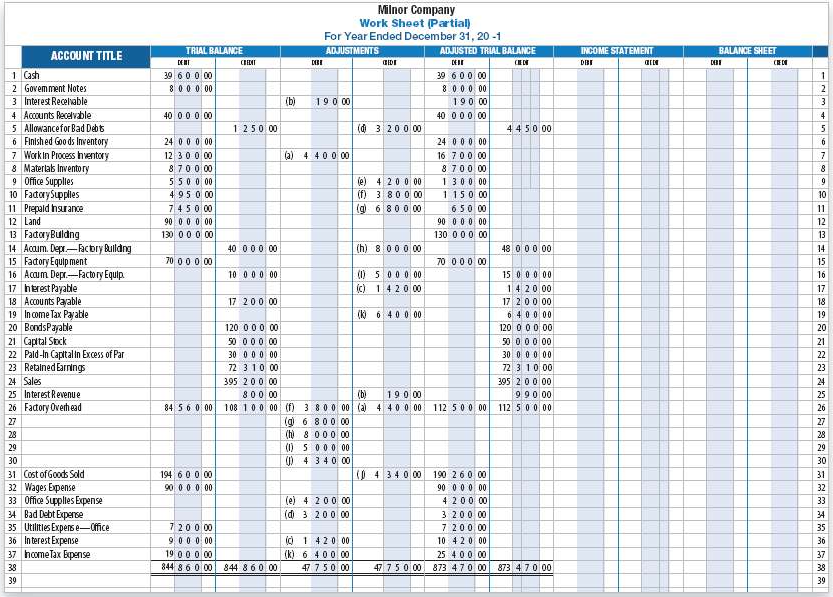

Question: ADJUSTING, CLOSING, AND REVERSING ENTRIES A partial work sheet for Milnor Company is shown on the next page. Data for adjusting the accounts are as

ADJUSTING, CLOSING, AND REVERSING ENTRIES A partial work sheet for Milnor Company is shown on the next page. Data for adjusting the accounts are as follows:

(a) Factory overhead to be applied to work in process ending inventory .....$4,400

(b) Interest receivable ...................................190

(c) Interest payable ....................................1,420

(d) Estimate of uncollectible accounts, based on an aging

of accounts receivable ..................................4,450

(e) Office supplies consumed .............................4,200

(f) Factory supplies consumed ............................3,800

(g) Insurance on factory building and equipment

expired ........................................6,800

(h) Factory building depreciation ...........................8,000

(i) Factory equipment depreciation ........................5,000

(j) Overapplied factory overhead ...........................4,340

(k) Provision for corporate income taxes ........................6,400

REQUIRED

1. Prepare the December 31 adjusting journal entries for Milnor Company.

2. Prepare the December 31 closing journal entries for Milnor Company.

3. Prepare the reversing journal entries as of January 1, 20-2, for MilnorCompany.

Milnor Company Work Sheet (Partial) For Year Ended December 31, 20 -1 ADJUSTED TRIAL BALANCE ADJUSTMENTS BALANCE SHEET TRIAL BALANCE INCOME STATEMENT ACCOUNT TITLE DEHI CBENT GIDI DEIE DBI CEDI 39 600 00 1 Cash 2 Govemment Notes 3 Interest Recelvable 39 600 00 8 00 0 00 8 00 0 00 190 00 (b) 190 00 40 000 00 4 Accounts Recelvable 40 000 00 5 Allowancefor Bad Debts 6 Finished Goo ds Inventory 7 Workin Process hentory 8 Materlak Inventory 9 Office Supplies 10 FadarySupples 11 Prepald hsurance 12 Land 13 FadoryBuldng 14 Acaum. Depr.-acbry Buldng 15 Fadory Equlp ment 16 Acaum Depr.-Facto ry Equip 17 herest Payable 18 Accounts Payable 19 In come Tax Payable 20 BondsPayable 21 Capital Stck 22 Pald-In Captalin Excess of Par 23 Retalned Earrings 24 Sales 1 250 00 (d 3 200 00 4450 00 24 0 0 0 00 24 000 00 (a) 4 400 00 16 700 00 12 300 00 8700 00 8700 00 550 0 00 4950 00 le) 4 200 00 (f) 380000 1300 00 1150 00 10 (g) 6 8000 7450 00 650 00 11 90 00 0 00 90 000 00 12 130 000 00 130 000 00 13 (h) 8 000 00 40 000 00 48 000 00 14 70 00 0 00 70 000 00 15 () 5000 00 ) 1420 00 15 00 0 00 1420 00 10 000 00 16 17 17 200 00 17 200 00 18 (k) 6 40 0 00 6 400 00 19 120 000 00 120 0 00 00 20 50 000 00 50 000 00 21 30 000 00 30 0 00 00 22 72 310 00 72 3 10 00 23 395 200 00 395 200 00 24 25 Interest Revenue (b) 800 00 190 00 990 00 25 84 5 6 0 00 1 08 100 00 (f) 3 800 00 (a) 4 40 0 00 112 500 00 (g 6 800 00 (h) 8 000 00 (1) S00 0 00 ) 4 3 40 00 26 Fadory Overhead 112 500 00 26 27 27 28 28 29 29 30 30 194 600 00 90 0 0 0 00 (0 4 340 00 Cost of Goods Sold 31 190 260 00 31 32 Wages Expense 33 Office Supplies Expense 34 Bad Debt Experse 35 Utilitles Expens e--Office 36 In terest Expense 37 homeTax Epense 90 000 00 32 (e) 4 200 00 4 200 00 33 (d 3 200 00 3 200 00 34 7200 00 9 00 0 00 19 00 0 00 844 8 60 00 7 200 00 35 (O 1 420 00 (k)6 400 00 10 420 00 36 25 400 00 37 47 750 00 38 844 8 60 00 47 750 00 873 470 00 873 4 70 00 38 39 39

Step by Step Solution

3.44 Rating (170 Votes )

There are 3 Steps involved in it

1 2 3 DATE 201 Dec DESCRIPTION Adjusting Entries a ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

73-B-A-F-S (1060).docx

120 KBs Word File