Question: Aero Tech Testing is considering investing in a new testing device. It has two options: Option A would have an initial lower cost but would

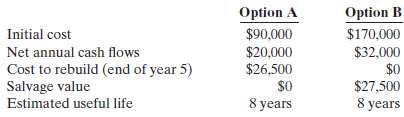

Aero Tech Testing is considering investing in a new testing device. It has two options: Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 5 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were provided. The company's cost of capital is 9%.

Instructions

(a) Compute the

(1) Net present value, and

(2) Internal rate of return for each option.

(b) Which option should beaccepted?

Option B Option A Initial cost Net annual cash flows Cost to rebuild (end of year 5) Salvage value Estimated useful life $90,000 $20,000 $26,500 $170,000 $32,000 $27,500 8 years 8 years

Step by Step Solution

3.19 Rating (160 Votes )

There are 3 Steps involved in it

a 1 Option A Cash Flows X 9 Discount Factor Present Value Present value of net annual cash flows Pre... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

54-B-M-A-C-B-D (151).docx

120 KBs Word File