Allocating Costs to Divisions Gether Corporation manufactures appliances. It has four divisions: Refrigerator, Stove, Dishwasher, and Microwave

Question:

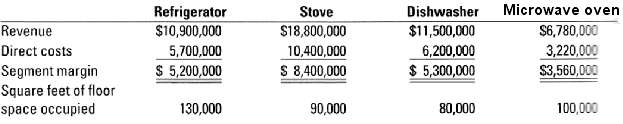

Allocating Costs to Divisions Gether Corporation manufactures appliances. It has four divisions: Refrigerator, Stove, Dishwasher, and Microwave oven. Each division is located in a different city and the quarters is located in Oakland, California. Headquarters incurs a total of $14,255,000 in costs, none of which are direct costs of any of the divisions. Revenues, costs, and facility space for each division are as follows:

Gether wants to allocate the indirect costs of headquarters on the basis of either square feet or segment margin for each division.

1. Allocate the indirect headquarters costs to each division, first using square feet of space and then using segment margin as the allocation base. Calculate the division operating margins after each allocation in dollars and as a percentage of revenues.

2. Which allocation base do you prefer? Why?

3. Should any of the divisions be dropped based on your calculations? Why or whynot?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav