Question: Amalgamated Products has three operating divisions: To estimate the cost of capital for each division, Amalgamated has identified the following three principal competitors: Assume these

Amalgamated Products has three operating divisions:

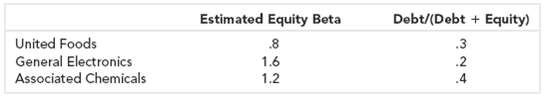

To estimate the cost of capital for each division, Amalgamated has identified the following three principal competitors:

Assume these betas are accurate estimates and that the CAPM is correct.

a. Assuming that the debt of these firms is risk-free, estimate the asset beta for each of Amalgamated's divisions.

b. Amalgamated's ratio of debt to debt plus equity is .4. If your estimates of divisional betas are right, what is Amalgamated's equity beta?

c. Assume that the risk-free interest rate is 7 percent and that the expected return on the market index is 15 percent. Estimate the cost of capital for each of Amalgamated?s divisions.

d. How much would your estimates of each division's cost of capital change if you assumed that debt has a beta of .2?

Division Food Electronics Chemicals Percentage of Firm Value 50 30 20

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

a b c d With riskfree ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-R-A-R (144).docx

120 KBs Word File