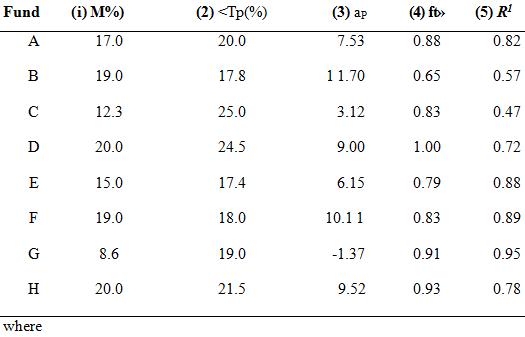

Question: Annual total returns for nine years are shown below for eight mutual funds. Characteristic lines are calculated using annual market returns. The ex post values

Annual total returns for nine years are shown below for eight mutual funds. Characteristic lines are calculated using annual market returns. The ex post values are as follows:

Rp = mean annual total return for each fund ap — the constant of the characteristic line f3P= the slope

Using an 8.6 percent risk-free return,

a. Calculate Sharpe's RVAR for each of these eight funds and rank the eight funds from high to low performance.

b. Calculate Treynor's RVOL for each fund and perform the same ranking as in part a.

c. Use the R2 in column 5 to comment on the degree of diversification of the eight mutual funds. Which fund appears to be the most highly diversified? Which fund appears to be the least diversified?

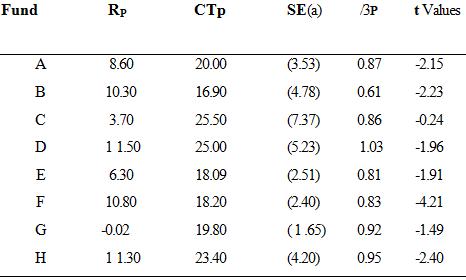

d. The returns, standard deviations, and characteristic lines were recalculated using the annual Treasury bill rate. The results are shown in the following table in excess yield form:

In the column to the right of the a P is the calculated standard error of alpha [SE (a)]. The critical value of t for 7 degrees of freedom (number of observations minus 2) for a two-tailed test at the 5 percent level is 2.365. With a large number of degrees of freedom, the critical value of t is close to 2.00. If the absolute value in that column exceeds 2.365, that fund's alpha is significantly different from zero. Which funds exhibit above, or below, average performance?

e. Compare the values of a and 0 calculated in excess yield form with those calculated initially.

Fund (i) M%) 17.0 19.0 12.3 20.0 15.0 19.0 8.6 20.0 (2) (%) 20.0 17.8 25.0 24.5 17.4 18.0 19.0 21.5 (3) ap 4 fo (5) R1 7.53 11.70 3.12 9.00 6.15 10.11 1.37 9.52 0.88 0.82 0.57 0.47 0.72 0.88 0.89 0.95 0.78 0.65 0.83 1.00 0.79 0.83 0.91 0.93 where Fund Rp SE(a) BPtValues 8.60 10.30 3.70 11.50 6.30 10.80 0.02 1130 20.00 16.90 25.50 25.00 18.09 18.20 19.80 23.40 653) 087 2.15 (4.78) 0.6 223 737) 086 024 (523)1.03196 (251 08 191 (240) 083 421 (165 092 149 (420) 095 2.40

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

a For some of the funds the RVAR are shown to an additional number of decimal places in order to eli... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

650-B-A-I (7691).docx

120 KBs Word File