Question: Answer this question by drawing graphs like Figure. Casper Milk toast has $200,000 available to support consumption in periods 0 (now) and 1 (next year).

Answer this question by drawing graphs like Figure. Casper Milk toast has $200,000 available to support consumption in periods 0 (now) and 1 (next year). He wants to consume exactly the same amount in each period. The interest rate is 8 percent. There is no risk.

a. How much should he invest, and how much can he consume in each period?

b. Suppose Casper is given an opportunity to invest up to $200,000 at 10 percent risk free. The interest rate stays at 8 percent. What should he do, and how much can he consume in each period?

c. What is the NPV of the opportunity in(b)?

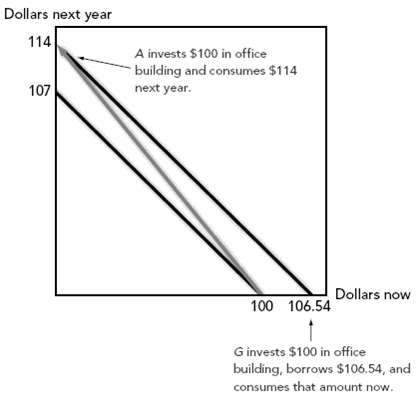

Dollars next year 114 A invests $100 in office building and consumes $114 next year. 107 Dollars now 100 106.54 G invests $100 in office building, borrows $106.54, and consumes that amount now.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

a Let x the amount that Casper should invest now Then 200000 x is the amount he will consume now and ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-P-V (12).docx

120 KBs Word File