Question: As kill Corporation (As kill), a public corporation, has concluded negotiations with Basket Corporation (Basket) for the purchase of all of Baskets net assets at

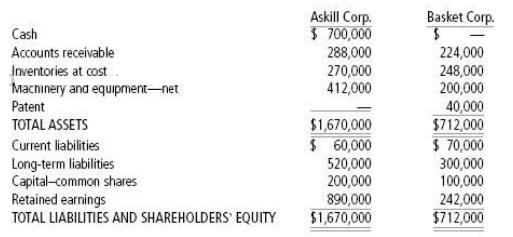

As kill Corporation (As kill), a public corporation, has concluded negotiations with Basket Corporation (Basket) for the purchase of all of Basket’s net assets at fair value, effective January 1, 20X7. An examination at that date by independent experts disclosed that the fair value of Basket’s inventories was $ 300,000; the fair value of its machinery and equipment was $ 320,000.

Additional Information:

• The fair value of the patent was $ 62,000. The values of the accounts receivable and of the current and long- term liabilities were equal to their carrying value.

• The purchase agreement stated that the purchase price of all the net assets will be $ 540,000 payable in cash.

• Both corporations have December 31 year- ends. The statements of financial position of both corporations, as at the date of the implementation of the purchase agreement (January 1, 20X7), are as follows:

Required

1. What is the amount of goodwill that would be recorded for the business combination?

2. Prepare As kill’s SFP at January 1, 20X7.

Askill Corp. $ 700,000 288,000 270,000 412,000 Basket Corp. Cash 224,000 248,000 200,000 Accounts receivable Inventories at cost Macninery and equipment-net 40,000 $712,000 $ 70,000 300,000 100,000 242,000 $712,000 Patent $1,670,000 $ 60,000 520,000 200,000 890,000 $1,670,000 TOTAL ASSETS Current liabilities Long-term liabilities Capital-common shares Retained earnings TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

1 Calculation of goodwill Consideration given 540000 Consideration received Fair value of net assets ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

424-B-A-G-F-A (5572).docx

120 KBs Word File