Asset Acquisition: At 31 December 20X4, certain accounts included in the property, plant, and equipment section of

Question:

Asset Acquisition: At 31 December 20X4, certain accounts included in the property, plant, and equipment section of Hint Corporation’s balance sheet had the following balances:

Land ..............................................$ 1,200,000

Buildings ..........................................2,600,000

Leasehold improvements ...........1,600,000

Machinery and equipment ...........3,200,000

During 20X5, the following transactions occurred:

a. Land site number 101 was acquired for $ 6,000,000. Additionally, to acquire the land, Hint paid a $ 360,000 commission to a real estate agent. Costs of $ 60,000 were incurred to clear the land. During the course of clearing the land, timber and gravel were recovered and sold for $ 32,000.

b. A second tract of land (site number 102) with a building was acquired for $ 1,200,000. The closing statement indicated that the land value was $ 800,000 and the building value was $ 400,000. Shortly after acquisition, the building was demolished at a cost of $ 80,000. A new building was constructed for $ 600,000 plus the following costs:

Excavation fees..................... $ 24,000

Architectural design fees ........32,000

Building permit fee ...................8,000

The building was completed and occupied on 30 September 20X5.

c. A third tract of land (site number 103) was acquired for $ 3,000,000 and was put on the market for resale.

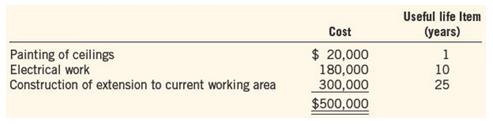

d. Extensive work was done to a building occupied by Hint under a lease agreement that expires on 31 December 20X14. The total cost of the work was $ 500,000, as follows:

The lessor paid half the costs incurred for the extension to the current working area.

e. During December 20X5, $ 240,000 was spent to improve leased office space.

f. A group of new machines was purchased subject to a royalty agreement, which requires payment of royalties based on units of production for the machines. The invoice price of the machines was $ 540,000, freight costs were $ 4,000, unloading costs were $ 6,000, and royalty payments for 20X5 were $ 88,000.

Required:

Disregard the related accumulated depreciation accounts.

1. Prepare a detailed analysis of the changes in each of the following balance sheet accounts for 20X5:

a. Land b. Buildings

c. Leasehold improvements

d. Machinery and equipment

2. What items would appear on the SCF in relation to the accounts in part (1)?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0071339476

Volume 1, 6th Edition

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I