Question: Assume the same facts as in Problem 32, except that the group members have adopted the relative tax liability tax-sharing method. In Problem The Chief

Assume the same facts as in Problem 32, except that the group members have adopted the relative tax liability tax-sharing method.

In Problem

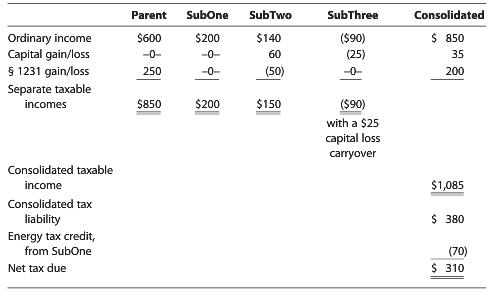

The Chief consolidated group reports the following results for the tax year. Dollar amounts are listed in millions.

Parent SubOne SubTwo SubThree Consolidated $600 0- 250 140 60 (50) S 850 35 200 $200 ($90) (25) Ordinary income Capital gain/loss 5 1231 gain/loss Separate taxable $850 $200 150 ($90) with a $25 capital loss carryover incomes Consolidated taxable ncome $1,085 Consolidated tax liability 380 Energy tax credit, from SubOne Net tax due 310

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Consolidated tax liabilities are shared in the following ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

527-L-B-L-P-C-L (670).docx

120 KBs Word File