Assume you are purchasing an investment and decide to invest in a company in the home remodeling

Question:

Assume you are purchasing an investment and decide to invest in a company in the home remodeling business. You narrow the choice to Hudson, Inc., or Madison, Corp. You assemble the following selected data:

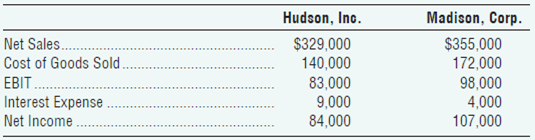

Selected income statement data for the current year:

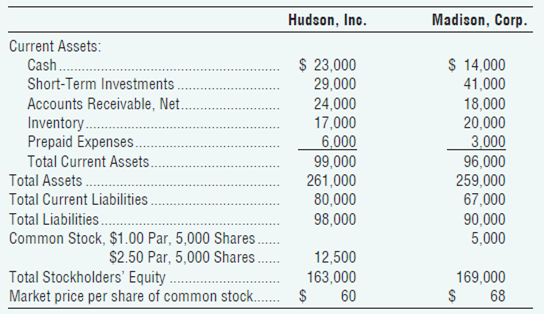

Selected balance sheet and market price data at the end of the current year:

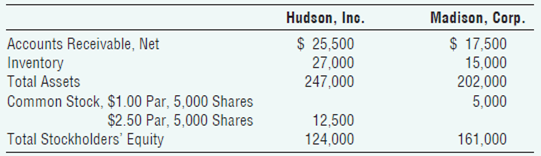

Selected balance sheet data at the beginning of the current year:

Your investment strategy is to purchase the stock of the company that has a low price earnings ratio but appears to be in good shape financially. Assume that you analyzed all other factors and your decision depends on the results of the ratio analysis to be performed.

Requirements

Compute the following ratios for both companies for the current year and decide which company’s stock better fits your investment strategy. Assume all sales are on credit.

a. Quick ratio

b. Debt ratio

c. Interest coverage ratio

d. Accounts receivable turnover

e. Inventory turnover

f. Total asset turnover

g. Return on assets

h. Return on equity

i. Earnings per share

j. Price-earnings ratio

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: