Question: At December 31, 2011, when the fair values of Sam Corporation's net assets were equal to their book values of $240,000, Pit Corporation acquired an

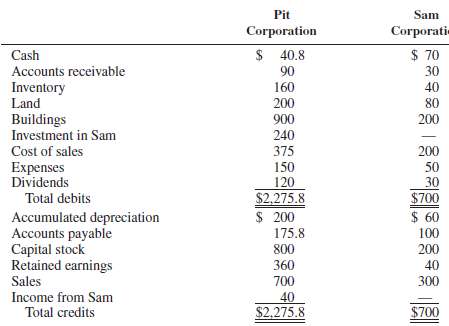

At December 31, 2011, when the fair values of Sam Corporation's net assets were equal to their book values of $240,000, Pit Corporation acquired an 80 percent interest in Sam for $224,000. One year later, at December 31, 2012, the comparative adjusted trial balances of the two corporations appear as follows (in thousands):

ADDITIONAL INFORMATION: During 2012, Sam Corporation sold inventory items costing $15,000 to Pit for $23,000. Half of these inventory items remain unsold at December 31, 2012.REQUIRED: Prepare comparative consolidated financial statements for Pit Corporation and Subsidiary at and for the year ended December 31, 2012, under1. Traditional theory2. Parent-company theory3. Entity theory

Pit Sam Corporati Corporation $ 40.8 $ 70 Cash Accounts receivable Inventory Land 90 30 160 40 200 80 Buildings Investment in Sam 900 200 240 Cost of sales 375 200 Expenses Dividends Total debits 150 120 50 30 $700 $2,275.8 $ 200 $ 60 Accumulated depreciation Accounts payable Capital stock Retained earnings Sales 175.8 100 800 200 360 40 700 300 Income from Sam Total credits 40 $2,275.8 $700

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Preliminary computations Parent company theory Investment in Sam 224000 Fair value of 80 interest acquired 240000 80 192000 Goodwill 32000 Entity Theo... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-C (102).docx

120 KBs Word File