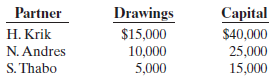

At the end of its first year of operations on December 31, 2010, KAT Companys accounts show

Question:

At the end of its first year of operations on December 31, 2010, KAT Company’s accounts show the following.

The capital balance represents each partner’s initial capital investment. Therefore, net income or net loss for 2010 has not been closed to the partners’ capital accounts.

Instructions

(a) Journalize the entry to record the division of net income for 2010 under each of the independent assumptions shown on the next page.

(1) Net income is $50,000. Income is shared 5:3:2.

(2) Net income is $40,000. Kirk and Andres are given salary allowances of $15,000 and $10,000, respectively. The remainder is shared equally.

(3) Net income is $37,000. Each partner is allowed interest of 10% on beginning capital balances. Kirk is given an $20,000 salary allowance. The remainder is shared equally.

(b) Prepare a schedule showing the division of net income under assumption (3) above.

(c) Prepare a partners’ capital statement for the year under assumption (3) above.

Step by Step Answer:

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso