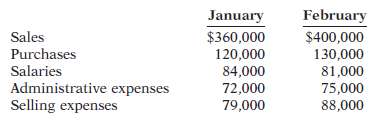

Question: Austin Corporation prepares monthly cash budgets. Here are relevant data from operating budgets for 2012.. All sales and purchases are on account. Budgeted collections and

Austin Corporation prepares monthly cash budgets. Here are relevant data from operating budgets for 2012..

All sales and purchases are on account. Budgeted collections and disbursement data are given below. All other expenses are paid in the month incurred except for administrative expenses, which include $1,000 of depreciation per month. Other data.1. Collections from customers: January $326,000; February $378,000.2. Payments for purchases: January $110,000; February $135,000.3. Other receipts: January: collection of December 31, 2011, notes receivable $15,000;February: proceeds from sale of securities $4,000.4. Other disbursements: February $10,000 cash dividend.The company??s cash balance on January 1, 2012, is expected to be $46,000. The company wants to maintain a minimum cash balance of $40,000.InstructionsPrepare a cash budget for January and February

February January $400,000 Sales $360,000 120,000 Purchases Salaries 130,000 Administrative expenses Selling expenses 72,000 79,000 88,000

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

AUSTIN CORPORATION Cash Budget For the Two Months Ending February 2... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

48-B-C-A-I-C-C (187).docx

120 KBs Word File