Question: Aztec Financial Services Ltd. needs to raise $3,000,000 to expand company operations. Aztec's president is considering the issuance of either Plan A: $3,000,000 of

Aztec Financial Services Ltd. needs to raise $3,000,000 to expand company operations. Aztec's president is considering the issuance of either

• Plan A: $3,000,000 of 4 percent bonds payable to borrow the money

• Plan B: 300,000 common shares at $10.00 per share

Before any new financing, Aztec Financial Services Ltd. expects to earn net income of $900,000, and the company already has 300,000 common shares outstanding. The president believes the expansion will increase income before interest and income tax by $600,000. The company's income tax rate is 40 percent.

Required

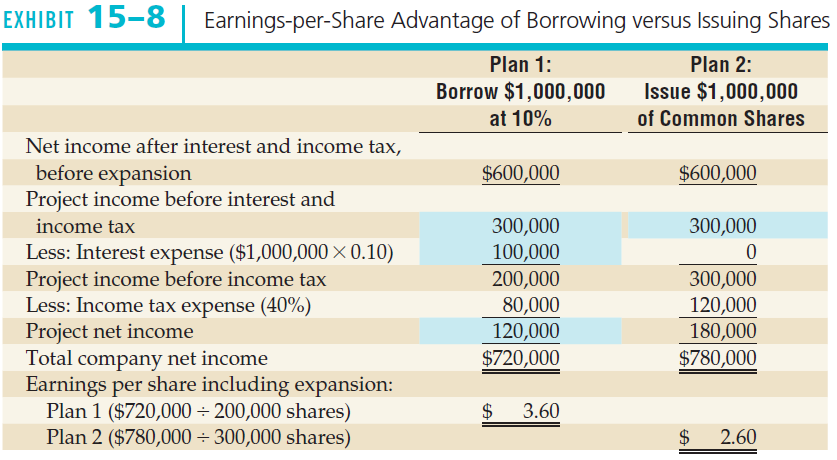

Prepare an analysis similar to Exhibit 15-8, to determine which plan is likely to result in the higher earnings per share. Which financing plan would you recommend for Aztec Financial Services Ltd.? Give your reasons.

EXHIBIT 15-8 Earnings-per-Share Advantage of Borrowing versus Issuing Shares Plan 1: Plan 2: Borrow $1,000,000 at 10% Issue $1,000,000 of Common Shares Net income after interest and income tax, before expansion Project income before interest and $600,000 $600,000 income tax 300,000 100,000 200,000 80,000 120,000 $720,000 300,000 Less: Interest expense ($1,000,000 0.10) Project income before income tax Less: Income tax expense (40%) Project net income Total company net income Earnings per share including expansion: Plan 1 ($720,000 200,000 shares) Plan 2 ($780,000 300,000 shares) 300,000 120,000 180,000 $780,000 $ 3.60 2.60

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Aztec Financial Services Ltd PLAN A BORROW 3000000 AT 4 PLAN B ISSUE 3000000 of COMMON SHARES Net i... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1147-B-A-L(6514).docx

120 KBs Word File