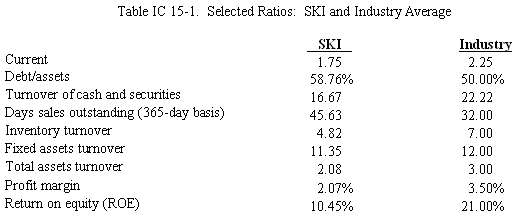

Question: Barnes knows that SKI sells on the same credit terms as other firms in the industry. Use the ratios presented in Table IC 15-1 to

Barnes knows that SKI sells on the same credit terms as other firms in the industry. Use the ratios presented in Table IC 15-1 to explain whether SKI?s customers pay more or less promptly than those of its competitors. If there are differences, does that suggest that SKI should tighten or loosen its credit policy? What four variables make up a firm?s credit policy, and in what direction should each be changed by SKI?

Table IC 15-1. Selected Ratios: SKI and Industry Average SKI Industry Current 1.75 2.25 Debt/assets 58.76% 50.00% Turnover of cash and securities 16.67 22.22 Days sales outstanding (365-day basis) Inventory turnover 45.63 32.00 4.82 7.00 Fixed assets turnover 11.35 12.00 Total assets turnover 2.08 3.00 Profit margin Return on equity (ROE) 2.07% 3.50% 10.45% 21.00%

Step by Step Solution

3.40 Rating (172 Votes )

There are 3 Steps involved in it

SKIs DSO is 4563 days as compared with 32 days for the average firm in its industry This suggests that SKIs customers are paying less promptly than th... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

43-B-F-F-M (598).docx

120 KBs Word File