Question: Barnes plans to use the ratios in Table IC 15-1 as the starting point for discussions with SKI?s operating executives. He wants everyone to think

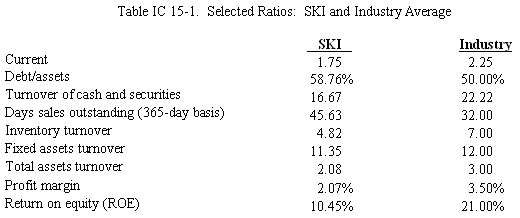

Barnes plans to use the ratios in Table IC 15-1 as the starting point for discussions with SKI?s operating executives. He wants everyone to think about the pros and cons of changing each type of current asset and the way changes would interact to affect profits and EVA. Based on the data in Table IC 15-1, does SKI seem to be following a relaxed, moderate, or restricted working capital policy?

Table IC 15-1. Selected Ratios: SKI and Industry Average SKI Industry Current 1.75 2.25 Debt/assets 58.76% 50.00% Turnover of cash and securities 16.67 22.22 Days sales outstanding (365-day basis) Inventory turnover 45.63 32.00 4.82 7.00 Fixed assets turnover 11.35 12.00 Total assets turnover 2.08 3.00 Profit margin Return on equity (ROE) 2.07% 3.50% 10.45% 21.00%

Step by Step Solution

3.41 Rating (179 Votes )

There are 3 Steps involved in it

A company with a relaxed working capital policy would carry relatively large ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

43-B-F-F-M (589).docx

120 KBs Word File