Bayly Corporation owns and operates a successful chain of retail pipe and tobacco stores. Bayly is a

Question:

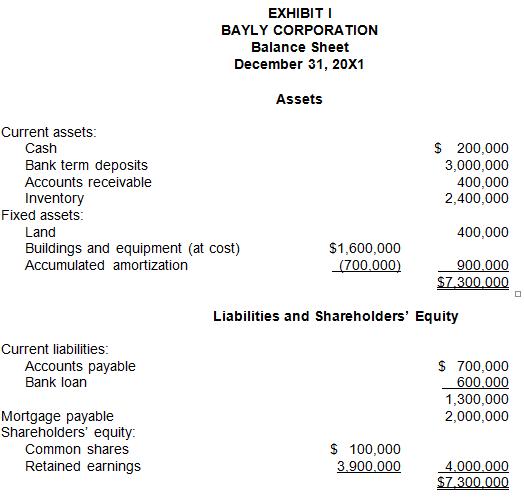

Bayly Corporation owns and operates a successful chain of retail pipe and tobacco stores. Bayly is a private corporation owned 100% by a large venture capital corporation. During 20X1, Bayly earned a net profit before tax of $2,000,000, and its most recent balance sheet (see Exhibit 1, next page) shows its financial strength.

Bayly has accumulated large cash reserves for the purpose of acquiring a pipe-manufacturing business. Initially, Bayly was going to construct its own manufacturing plant, but recently it has targeted TOTO Pipes Ltd., a manufacturer of bluestem pipes, as a possible acquisition.

Donna Rose has been given the assignment of reporting to the VP Finance on the feasibility of acquiring TOTO. Rose attends a meeting with the shareholders of TOTO Pipes and the vice-president of Bayly Corporation. The meeting is short, as its purpose is to get acquainted and gather preliminary information. Rose is able to gather the following information:

1. The common shares of TOTO are owned equally by John Drabinsky and Walter Scully. They started the corporation 15 years ago, when pipe smoking was again becoming popular.

2. In addition to providing the initial share capital, Scully had provided a substantial shareholder loan to TOTO Pipes that enabled the company to survive during its critical start-up years. This loan was paid off two years ago. Scully is a director of TOTO Pipes but is only partly active in its management. He also owns another business, with his son and daughter, where he spends most of his time. Walter Drabinsky is the president and senior manager.

3. Both Drabinsky and Scully are 62 years of age.

4. Drabinsky indicates that he and Scully are prepared to sell all of the assets of TOTO Pipes for the values indicated under “Additional Information” in Exhibit II. If, however, Bayly wants to acquire the shares, they are willing to consider a price of $2,600,000.

5. Certain financial information is provided by Drabinsky (see Exhibit II).

After the meeting, Bayly’s vice-president instructs Rose to prepare a preliminary report on the proposed acquisition. “First of all, we want to know if the prices indicated make sense, considering that Bayly’s parent company insisted on a 13% after-tax return before approving any major capital acquisitions. I’m a little concerned about the life expectancy of the business because the patent on their major product has a life of only 10 years. They seem to be willing to accept a lower price for the shares than for the assets, and I wonder if they may be willing to accept an even lower share price. It would be useful to have this information before we enter into serious negotiations. In addition, provide any other analysis that might help us make a decision.”

Rose begins her assignment by gathering certain tax information and determines that the maximum personal tax rates are 45% on most types of income. Dividends, however, are subject to 28% tax rate on eligible dividends and a 35% rate on non-eligible dividends (net of the dividend tax credit). Rose was unable to determine what dividends from TOTO would be eligible or non-eligible and would have to make an assumption. The corporate rates of tax are 15% for income subject to the small-business deduction, 25% for non-manufacturing income not subject to the small-business deduction, and 23% for manufacturing income. The tax rate on investment income is 44 2/3%, which includes the 6 2/3% refundable tax.

Required:

Prepare the preliminary report.

Additional information

1. Over the past three years, the company profits have averaged $750,000 before depreciation, amortization, and income taxes. This average is expected to continue in future years.

2. The company operates solely in Saskatchewan.

3. Total salaries paid in 20X1 amounted to $400,000, of which $300,000 related directly to manufacturing and $100,000 was for management.

4. All fixed assets were used for manufacturing purposes.

5. The patent on a special pipe filter has 10 years of legal life remaining.

6. Inventory shows a cost of $700,000.However, the company has indicated that the actual cost was $800,000, as the company intentionally lowered its inventory to reduce taxes.

7. The fair market values of other assets are as follows:

Land………………………… | $200,000 |

Building ………………………… | 700,000 |

Equipment ………………………… | 600,000 |

Patent ………………………… | 300,000 |

Goodwill ………………………… | 400,000 |

8. The UCC of the depreciable assets is as follows:

Class 3 ………………………… | $150,000 |

Class 43 ………………………… | 300,000 |

Class 44 ………………………… | –0– |

The balance in the cumulative eligible capital account is $40,000.

9. The general rate income pool (GRIP) balance is nil.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold