Question: BDD Partnership is a service-oriented partnership that has three equal general partners. One of them, Barry, sells his interest to another partner, Dale, for $90,000

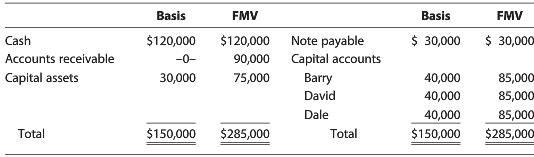

BDD Partnership is a service-oriented partnership that has three equal general partners. One of them, Barry, sells his interest to another partner, Dale, for $90,000 cash and the assumption of Barry’s share of partnership liabilities. Immediately before the sale, the partnership’s cash basis balance sheet is as shown below. Assume that the capital accounts before the sale reflect the partners’ bases in their partnership interests, excluding liabilities. The payment exceeds the stated fair market value of the assets because of goodwill that is not recorded on the books.

a. What is the total amount realized by Barry on the sale?

b. How much, if any, ordinary income must Barry recognize on the sale?

c. How much capital gain must Barry report?

d. What is Dale’s basis in the partnership interest acquired?

Basis FMV Basis FMV Cash Accounts receivable Capital assets 120,000 $120,000 Note payable 30,000 30,000 90,000 Capital accounts 75,000 Barry 30,000 85,000 85,000 85,000 $150,000 $85,000 40,000 40,000 40,000 David Dale Total 150,000 $285,000 Total

Step by Step Solution

3.34 Rating (175 Votes )

There are 3 Steps involved in it

a b 30000 Barrys onethird share ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

527-L-B-L-T-L (556).docx

120 KBs Word File