Question: Below are recent financial ratios for a random sample of 20 integrated health care systems. Operating Margin is total revenue minus total expenses divided by

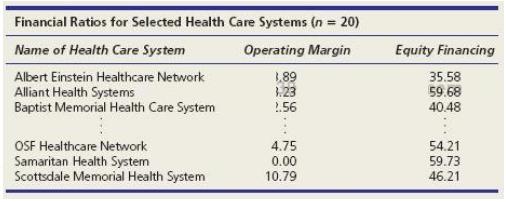

Below are recent financial ratios for a random sample of 20 integrated health care systems. Operating Margin is total revenue minus total expenses divided by total revenue plus net operating profits. Equity Financing is fund balance divided by total assets.

(a) Make a scatter plot of Y = operating margin and X = equity financing (both variables are in percent).

(b) Use Excel to t the regression, with fitted equation and R2.

(c) In your own words, describe the t.

Financial Ratios for Selected Health Care Systems (n # 20) Name of Health Care System Operating Margin Equity Financing Albert Einstein Healthcare Network Alliant Health Systems Baptist Memorial Health Care System .89 .23 2.56 35.58 59.68 40.48 OSF Healthcare Network Samaritan Health System Scottsdale Memorial Health System 4.75 0.00 10.79 54.21 59.73 46.21

Step by Step Solution

3.27 Rating (171 Votes )

There are 3 Steps involved in it

a b c The fit of this regression is weak as given by R 2 02474 24 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

485-M-S-L-R (3563).docx

120 KBs Word File