Question: Bitterroot Realty, Inc., organized October 1, 2011, is operated by Dale Flynn. How many errors can you find in the following financial statements for Bitterroot

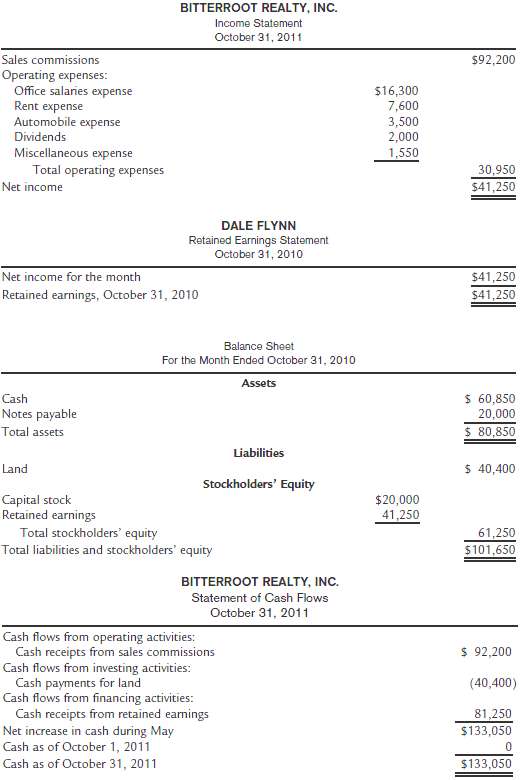

Bitterroot Realty, Inc., organized October 1, 2011, is operated by Dale Flynn. How many errors can you find in the following financial statements for Bitterroot Realty, Inc., prepared after its first month ofoperation?

BITTERROOT REALTY, INC. Income Statement October 31, 2011 $92,200 Sales commissions Operating expenses: Office salaries expense Rent expense Automobile expense $16,300 7,600 3,500 2,000 Dividends Miscellaneous expense 1,550 Total operating expenses 30,950 Net income $41,250 DALE FLYNN Retained Earnings Statement October 31, 2010 Net income for the month $41,250 $41,250 Retained earnings, October 31, 2010 Balance Sheet For the Month Ended October 31, 2010 Assets $ 60,850 20,000 Cash Notes payable $ 80,850 Total assets Liabilities $ 40,400 Land Stockholders' Equity Capital stock Retained earnings $20,000 41,250 Total stockholders' equity Total liabilities and stockholders' equity 61,250 5101,650 BITTERROOT REALTY, INC. Statement of Cash Flows Otober 31, 2011 Cash flows from operating activities: Cash receipts from sales commissions Cash flows from investing activities: Cash payments for land Cash flows from financing activities: Cash receipts from retained earnings Net increase in cash during May Cash as of October 1, 2011 Cash as of October 31, 2011 $ 92,200 (40,400) 81,250 $133,050 $133,050

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

1 All financial statements should contain the name of the business in their heading The retained earnings statement is incorrectly headed as Dale Flyn... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-A-F (221).docx

120 KBs Word File