Break-Even and Taxes This problem concerns the effect of taxes on the various break-even measures. a. Show

Question:

Break-Even and Taxes This problem concerns the effect of taxes on the various break-even measures.

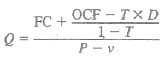

a. Show that, when we consider taxes, the general relationship between operating cash flow, OCF, and sales volume, Q, can be written as:

b. Use the expression in part (a) to the cash, accounting, and financial break-even points for the Wet way sailboat example in the chapter. Assume a 38 percent tax rate.

c. In part (b), the accounting break-even should be the same as before. Why? Verify this algebraically.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0077861629

8th Edition

Authors: Stephen A. Ross, Randolph W. Westerfield, Bradford D.Jordan

Question Posted: