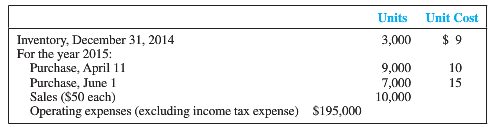

Question: Broadhead Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2015, the accounting records provided the following information

Broadhead Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2015, the accounting records provided the following information for product 2:

Required:

1. Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A: FIFO and (b) Case B: LIFO. For each case, show the computation of the ending inventory and cost of goods sold.

2. Compare the pretax income and the ending inventory amounts between the two cases. Explain the similarities and differences.

3. Which inventory costing method may be preferred for income tax purposes? Explain.

Unit Cost $ 9 Units Inventory, December 31, 2014 For the year 2015: Purchase, April 11 Purchase, June 1 Sales ($50 each) Operating expenses (excluding income tax expense) 3,000 9,000 7,000 10,000 10 15 $195,000

Step by Step Solution

3.32 Rating (167 Votes )

There are 3 Steps involved in it

Req 1 BROADHEAD COMPANY Income Statement For the Year Ended December 31 2015 Case A Case B FIFO LIFO ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

313-B-A-F-R (1326).docx

120 KBs Word File