Brown Corporation, a calendar year taxpayer, began operations in 2012. It reports the following unadjusted AMTI and

Question:

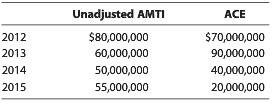

Brown Corporation, a calendar year taxpayer, began operations in 2012. It reports the following unadjusted AMTI and ACE for 2012 through 2015:

Calculate Brown’s positive and negative adjustments, if any, for ACE.

Transcribed Image Text:

Unadjusted AMTI $80,000,000 60,000,000 50,000,000 55,000,000 ACE 2012 2013 2014 2015 $70,000,000 90,000,000 40,000,000 20,000,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 52% (19 reviews)

The adjustment for adjusted current earnings is 75 of the excess if any of the ACE over ...View the full answer

Answered By

Joram mutua

I am that writer who gives his best for my student/client. Anything i do, i give my best. I have tutored for the last five years and non of my student has ever failed, they all come back thanking me for the best grades. I have a degree in economics, but i have written academic papers for various disciplines due to top-notch research Skills.In additional, I am a professional copywriter and proofreader.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

Question Posted:

Students also viewed these Business Law questions

-

Purple Corporation, a calendar year taxpayer, began operations in 2012. It reported the following amounts for its first four tax years. Calculate Purples positive and negative ACE adjustments for...

-

Purple Corporation, a calendar year taxpayer, began operations in 2014. It reported the following amounts for its first four tax years. Calculate Purple's positive and negative ACE adjustments for...

-

On June 5, 2014, Brown, Inc., a calendar year taxpayer, receives cash of $750,000 from the county upon condemnation of its warehouse building (adjusted basis of $500,000 and fair market value of...

-

Kyrsten Haas expects an S corporation investment to generate a profit of $200,000. Her share of the S corporation is 15%. What is Kyrstens income tax if no cash is distributed? Kyrsten's marginal tax...

-

How does managing your investments fit into your financial plan? What is the investment trade off?

-

Superheated steam at 575C is routed from a boiler to the turbine of an electric power plant through steel tubes (k = 35 W/m K) of 300 mm inner diameter and 30 mm wall thickness. To reduce heat loss...

-

The sensing element in many thermostats is a bimetallic strip (Figure 7.45), which is a nonsymmetric laminate consisting of two plies made from different metals. If the strip is subjected to a...

-

Rouse Company, a real estate developer, is well known as one of the few U.S. companies to have reported the current value of property and equipment in its financial statements. As mentioned in the...

-

The proper allocation of manufacturing overhead to products produced is required by Generally Accepted Accounting Principles (GAAP) and provides a sound basis for pricing products using a full cost...

-

18 The following audit procedures were performed in the audit of inventory to satisfy specific balance-related audit objectives. The audit procedures assume that the auditor has obtained the...

-

For 2015, Silver Corporation (a calendar year business) incurred the following transactions: Taxable income$3,950,000 Accelerated depreciation on pre-1987 real property (in excess of straight-line...

-

Gold Company manufactures a product and sells it with an embedded service. a. What does this mean? b. Give some examples of embedded services. c. Under what circumstances can the amount attributable...

-

True or False: 1. It is impossible to prove that a given income distribution is better than another. 2. According to the principle of diminishing marginal utility, increases in income generate...

-

a) A company just paid a dividend of Do = $5.00 on its preferred stock. The dividend amount will remain constant. The discount rate (i.e., market capitalization rate) of the company is k = 8%. What...

-

Curved arrows are used to illustrate the flow of electrons. Using the provided starting and product structures, draw the curved electron-pushing arrows for the following reaction or mechanistic...

-

Locate the Podcast titled Accounts Payable Clerk Steals $250,000 from Local Transit Entity on the ACFE website at https://acfe.podbean.com/?s=accounts payable Post your comments regarding the fraud...

-

Factor each expression: | 125x3 + 1 = 75-3 8a3 - 2763 =

-

Paraphrase this "To fight the 2008 financial crisis, the United States employed a combination of fiscal and monetary policies. On the budgetary front, Congress passed the ailing Asset Relief Program...

-

In Problems 67 90, multiply the polynomials using the special product formulas. Express your answer as a single polynomial in standard form. (2x + 3y)

-

If a test has high reliability. O the test measures what the authors of the test claim it measures O people who take the same test twice get approximately the same scores both times O scores on the...

-

Goodward, a newly hired newspaper reporter for the Cape Cod News, learned that the local cranberry growers had made an agreement under which they pooled their cranberry crops each year and sold them...

-

Food Caterers of East Hartford, Connecticut, obtained a franchise from Chicken Delight to use that name at its store. Food Caterers agreed to the product standards and controls specified by the...

-

Groseth had the International Harvester (IH) truck franchise in Yankton, South Dakota. The franchise agreement Groseth signed required dealers to "cooperate with the Company by placing orders for...

-

1. Q: What is Docker? 2. Q: What is a data lake? 3. Q: What is a NoSQL database? 4. Q: What is a software development methodology? 5. Q: What is cross-platform development? 6. Q: What is Moore's Law?...

-

1. Q: What is virtual memory? 2. Q: What is a hash function? 3. Q: What is A/B testing? 4. Q: What is machine learning? 5. Q: What is a software patch? 6. Q: What is the difference between symmetric...

-

1. Q: What is RAID (Redundant Array of Independent Disks)? 2. Q: What is a digital signature? 3. Q: What is cloud storage? 4. Q: What is responsive web design? 5. Q: What is the difference between...

Study smarter with the SolutionInn App