Question: Calculating the Direct Labor Rate Variance and the Direct Labor Efficiency Variance Refer to Cornerstone Exercise 9.1. Guillermos Oil and Lube Company provided the following

Calculating the Direct Labor Rate Variance and the Direct Labor Efficiency Variance Refer to Cornerstone Exercise 9.1. Guillermo’s Oil and Lube Company provided the following information for the production of oil changes during the month of June:

Actual number of oil changes performed: 980

Actual number of direct labor hours worked: 386 hours

Actual rate paid per direct labor hour: $14.50

Standard rate per direct labor hour: $14.00

Required:

1. Calculate the direct labor rate variance (LRV) and the direct labor efficiency variance (LEV) for June using the formula approach.

2. Calculate the direct labor rate variance (LRV) and the direct labor efficiency variance (LEV) for June using the graphical approach.

3. Calculate the total direct labor variance for oil changes for June.

4. What if the actual wage rate paid in June was $12.40? What impact would that have had on the direct labor rate variance (LRV)? On the direct labor efficiency variance (LEV)?

Exercise 9.1

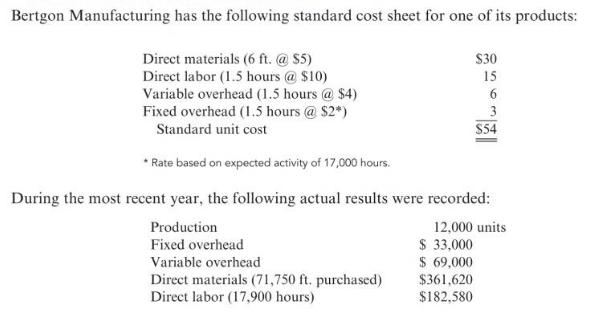

Bertgon Manufacturing has the following standard cost sheet for one of its products: Direct materials (6 ft. @ $5) Direct labor (1.5 hours @ $10) Variable overhead (1.5 hours @ $4) Fixed overhead (1.5 hours @ $2*) Standard unit cost S30 15 3 S54 * Rate based on expected activity of 17,000 hours. During the most recent year, the following actual results were recorded: Production 12,000 units $ 33,000 $ 69,000 $361,620 $182,580 Fixed overhead Variable overhead Direct materials (71,750 ft. purchased) Direct labor (17,900 hours)

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

1 Formulas Labor rate variance LRV AR SR AH 1450 1400386 193 U Labor efficiency varian... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

493-B-M-A-S-C (1509).docx

120 KBs Word File